Presence

We ‘Dil Se’ serve millions of our consumers with diverse banking needs through our extensive on- ground presence, class leading digital capabilities, coupled with deep focus on consumer engagement.

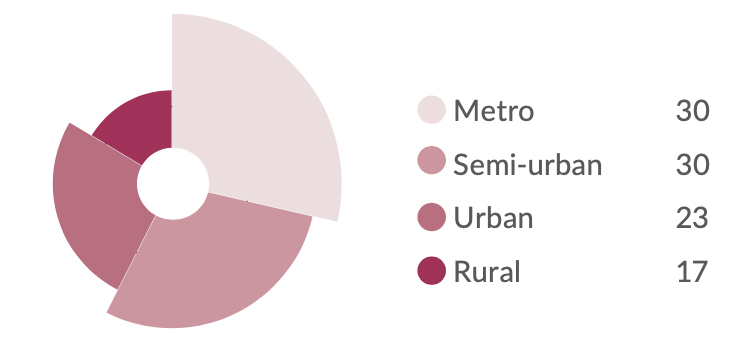

During the year, we have added 164 branches to our network. Around 17% of our branches are in rural India, of which 76% are in unbanked locations.

Our overseas presence is spread across seven international offices. We have consolidated our business through branches in Dubai, Singapore and GIFT City, India.

Branches and Extension Counters in India

ATMs and Cash Deposit/ Withdrawal machines

SME Centres

By transforming the way we engage and serve our consumers, we are reimagining their journeys by offering class-leading products and services.

Axis Mobile is among the highest- ranked banking app on the Apple Store (rating of 4.6) and Google Play Store (rating of 4.6). The app is quickly becoming a source of competitive advantage by offering 250+ DIY services (the highest in the industry) and covering about 65% of the branch's request volume.

In fiscal 2022, our consumers increased their adoption of digital banking driven by our newly launched products such as Buy Now Pay Later, WhatsApp Banking, Digital Forex card, and Wear n Pay to name a few.

Active Point of Sale (POS) machines

Active Credit Cards

Active Debit Cards

Known to Bank consumer base

Non-Axis Bank Consumers using Axis Mobile and Axis Pay apps

Unique Customer Opt-ins for WhatsApp Banking

Digitally active consumers

Value of digital channel transactions

Share of digital financial transactions**

Monthly active users on Axis Mobile Banking

** By individual consumers for fiscal 2022

^ For fiscal 2022

We use digital as an enabler to power all our interactions with consumers and swiftly move between online and offline. Our Axis Virtual Centres provide omnichannel reach to meet the demands of our consumers through virtual relationship managers. Combining the best of Artificial Intelligence, Machine Learning and Natural Language Processing, our virtual assistant, Axis AHA!, facilitates intelligent and instantaneous digital conversations to address queries on the go.

Axis Virtual Centre (AVC)

Virtual Relationship Managers

Virtual Conversations at AVC per month

AHA! conversations in fiscal 2022

Above are standalone figures as on/for year ended 31 March, 2022 unless otherwise mentioned