- Home

- Business Banking

- Payment Solutions

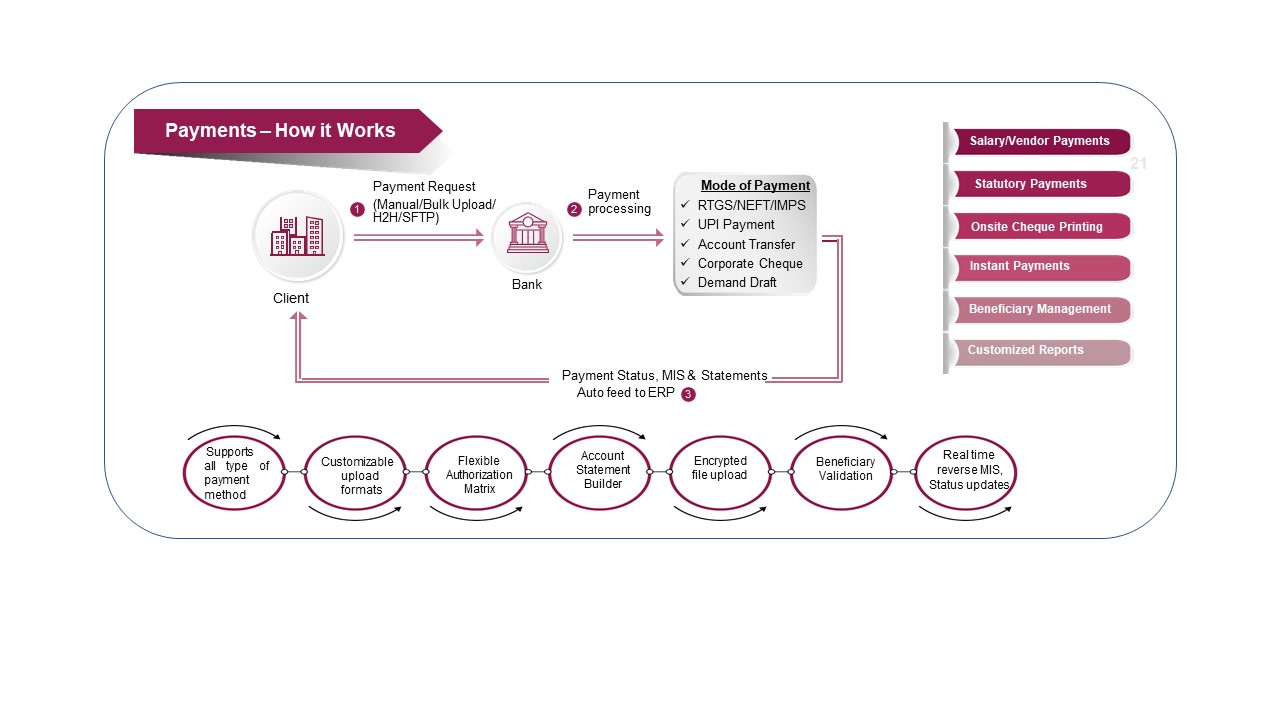

Payment Solutions

Axis Bank offers a wide range of cash management solutions to meet your payment needs i.e. DD/Cheque printing, bulk payments, statutory payments RTGS/NEFT/IMPS.

- Well distributed network

- Ease of initiating digital payment transactions

- Customised Reports for reconciliation

- Advisory Services

Paper based payments via Cheque, DDs with coverage across all Axis branch locations, clients can issue these payments along with customised advice basis file upload features.

Features and Benefits:

- Decentralized printing

- Single and Consolidated Debit

- Bulk Issuances

- Remote Cheque Printing i.e., printing at Axis Bank Branch or Customer premises

- Customized signatory mapping

- Detailed Payment advices & invoice information

- Single upload of transactions with multiple payment modes

Cash Delivery solution is offered to clients for their daily/weekly cash requirement or cash payment to different beneficiaries. Cash delivery can be availed via doorstep banking or pick-up from Axis branch network.

Features and Benefits:

- Centralised Cash delivery request across multiple locations

- Pre-filled beneficiary details to avoid re-capturing delivery locations

- Online Status tracking

- Centralised customised MIS at regular frequency

Electronic payments can be availed through branch, internet and mobile banking channels. Payment can be initiated via file upload, APIs or Host to Host integrations also.

Funds Transfer : Instant fund transfer to accounts within Axis Bank.

National Electronic Fund Transfer (NEFT): Transfer funds from Axis Bank account to another bank account participating in the scheme.

Real Time Gross Settlement (RTGS) : The RTGS system is primarily meant for large value transactions for transferring funds from one bank to another. The minimum amount to be remitted through RTGS is INR 2 lakh. There is no upper ceiling for RTGS transactions.

Immediate Payments service (IMPS) : Instant money transfer service via IFSC code with an upper limit of INR 2 lakh. Payment status is updated instantly and customised MIS can be shared via multiple channels.

Features and Benefits:

- Salary Payment with security features and HR Payroll needs

- Single file upload with all payment options

- Auto-Reconciliation into Client's system

- Single or consolidated debit in the account

- Flexible Authorization Matrix

- Beneficiary Validation

- Notifications via E-Mail, SMS and MIS through multiple channels.

Apply

Now

Apply

Now