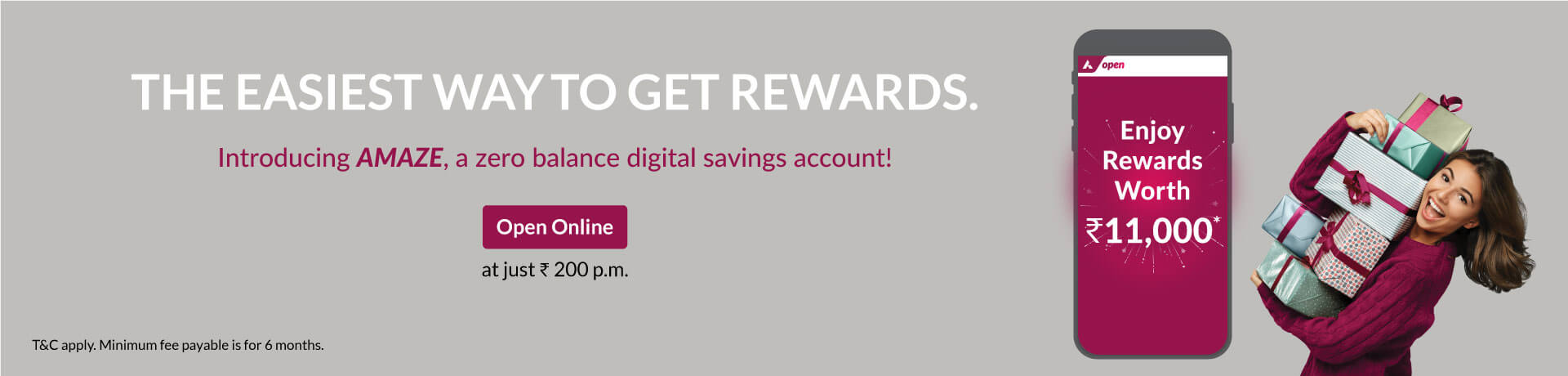

A Savings Account is a crucial financial tool offered by banks, enabling you to securely save money and earn interest. Its easy accessibility provides the convenience of depositing and withdrawing funds at your discretion, making it a highly flexible and liquid savings tool. Savings Account promotes financial discipline by offering a secure place to save and earn steady interest, with 24/7 access to your funds. Today, a savings account has become a one-stop solution for all your money management needs like transferring money, paying bills, shopping, addressing contingencies, and investing. Additionally, the cherry on top is the array of extra benefits, such as discounts and reward points on spending, coupled with a range of digital banking services. If you haven't opened a Savings Account yet, explore the various options available at Axis Bank and select the one that suits your specific needs.