Strong Profitability Performance

Operating Profitability remains strong

Provision Coverage enhanced

Asset quality metrics largely stable

Loan book growth remains healthy

Deposit Franchise had a strong quarter

Snapshot (As on Sept. 30th, 2019) (in ` Crores)

| Profit & Loss | Absolute (in ` Crs) | YOY Growth | ||

|---|---|---|---|---|

| Q2FY20 | H1FY20 | Q2FY20 | H1FY20 | |

| Net Interest Income | 6,102 | 11,945 | 17% | 15% |

| Fee Income | 2,649 | 5,312 | 11% | 18% |

| Operating Expenses | 4,046 | 7,866 | 6% | 4% |

| Operating Profit | 5,952 | 11,844 | 45% | 40% |

| Profit Before Tax | 2,433 | 4,511 | 109% | 105% |

| Net Profit / (Loss) | (112) | 1,258 | - | (16%) |

| Balance Sheet | Absolute (in ` Crs) | YOY Growth | ||

|---|---|---|---|---|

| Q2FY20 | ||||

| Total Assets | 809,294 | 11% | ||

| Net Advances | 521,594 | 14% | ||

| Total Deposits | 583,958 | 22% | ||

| Shareholders' Funds | 83,875 | 29% | ||

| Key Ratios | Absolute (in ` Crs) | YOY Growth |

|---|---|---|

| Q2FY20 | Q2FY19 | |

| Diluted EPS* (in `) (Q2/H1) | (1.69) / 9.59 | 12.17 / 11.55 |

| Book Value per share (in `) | 298 | 253 |

| ROA* (in %) (Q2/H1) | (0.06) / 0.31 | 0.43 / 0.41 |

| ROE* (in %) (Q2/H1) | (0.68) / 3.98 | 5.43 / 5.18 |

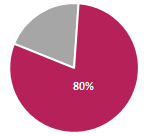

| Gross NPA Ratio | 5.03% | 5.96% |

| Net NPA Ratio | 1.99% | 2.54% |

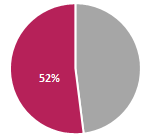

| Basel III Tier I CAR1 | 15.25% | 13.04% |

| Basel III Total CAR1 | 18.45% | 16.45% |

* Annualised

1 including profit for H1

22% YOY

22% YOY

19% YOY

19% YOY

Strong Profitability performance:

Operating Profitability remains strong:

Provision Coverage enhanced:

Asset quality metrics largely stable:

Strong Loan book growth:

Deposit franchise had a strong quarter:

Among the top players in the digital space:

The Bank’s Capital Adequacy Ratio (CAR) has strengthened post capital raise: Common Equity Tier 1 ratio stood at 14.04% compared to 11.68% at the end of Q1FY20.