Operating Profitability improved materially

Deposit Franchise had a strong quarter

Asset Quality metrics are progressing well

Provision Coverage continues to be strengthened

Growth metrics were healthy

Snapshot (As on June 30th, 2019) (in ` Crores)

| Profit & Loss | Q1FY20 | YOY Growth |

|---|---|---|

| Net Interest Income | 5,844/span> | 13% |

| Fee Income | 2,663 | 26% |

| Operating Expenses | 3,820 | 3% |

| Operating Profit | 5,893 | 35% |

| Net Profit | 1,370 | 95% |

| Balance Sheet | Q1FY20 | YOY Growth |

|---|---|---|

| Total Assets | 774,566 | 12% |

| Net Advances | 497,276 | 13% |

| Total Deposits | 540,678 | 21% |

| Shareholders' Funds | 71,228 | 11% |

| Key Ratios | Q1FY20 | FY19 |

|---|---|---|

| Diluted EPS (Annualised in `) | 21.14 | 10.93 |

| Book Value per share (in `) | 272 | 250 |

| ROA (Annualised) | 0.69% | 0.40% |

| ROE (Annualised) | 9.19% | 4.94% |

| Gross NPA Ratio | 5.25% | 6.52% |

| Net NPA Ratio | 2.04% | 3.09% |

| Basel III Tier I CAR1 | 12.90% | 13.22% |

| Basel III Total CAR1 | 16.06% | 16.71% |

1 including profit for Q1

21% YOY

21% YOY

19% YOY

19% YOY

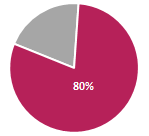

Operating Profitability improved significantly:

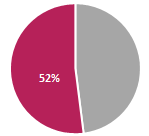

Provision Coverage enhanced:

Profitability continues to improve steadily:

Asset quality metrics continue to improve:

Continue to grow loan book cautiously and steadily:

Deposit franchise had a strong quarter:

Among the top players in the digital space:

The Bank’s Capital Adequacy Ratio (CAR) remains stable.