Balanced growth, improving profitability, resilient balance sheet

Steady growth in stable and granular retail deposits continues to aid loan growth

Steady operating performance

Well capitalized with adequate liquidity buffers

Loan growth driven by all three business segments

Leadership position in Digital with increased sourcing & innovative launches

Balance sheet buffers strengthened with high PCR and additional provisions

Key subsidiaries delivered strong performance, Max Life stake acquisition complete

QAB: Quarterly Average Balance

Coverage Ratio = Aggregate provisions (specific + standard + additional + Covid) / IRAC GNPA

Standard Assets Coverage Ratio (SACR) = Standard asset provisions plus additional provisions plus Covid provision / Standard loans

* Adjusted for provisions on proforma NPA in previous quarter Q3FY21

(1)Sequential and YoY RTD growth lower by 3%, due to decision on FCNR (B) deposits

Snapshot (As on March 31st, 2021) (in ` Crores)

| Profit & Loss | Absolute (in ` Crores) | YOY Growth | ||

|---|---|---|---|---|

| Q4FY21 | FY21 | Q4FY21 | FY21 | |

| Net Interest Income | 7,555 | 29,239 | 11% | 16% |

| Fee Income | 3,376 | 10,686 | 15% | (3%) |

| Operating Expenses | 5,359 | 18,375 | 8% | 6% |

| Operating Profit | 6,865 | 25,702 | 17% | 10% |

| Net Profit | 2,677 | 6,588 | - | 305% |

| Balance Sheet | Absolute (in ` Crores) | YOY Growth |

|---|---|---|

| FY21 | ||

| Total Assets | 996,118 | 9% |

| Net Advances | 623,720 | 9% |

| Total Deposits^ | 707,306 | 10% |

| Shareholders' Funds | 101,603 | 20% |

^ period end balances

| Key Ratios | Absolute (in ` Crores) | |

|---|---|---|

| FY21 | FY20 | |

| Diluted EPS* (in `) (Q4/FY) | 35.37 / 22.09 | (19.79) / 5.97 |

| Book Value per share (in `) | 332 | 301 |

| ROA* (in %) (Q4/12M) | 1.11 / 0.70 | (0.62) / 0.20 |

| ROE* (in %) (Q4/12M) | 11.72 / 7.55 | (7.08) / 2.34 |

| Gross NPA Ratio | 3.70% | 4.86% |

| Net NPA Ratio | 1.05% | 1.56% |

| Basel III Tier I CAR | 16.47% | 14.49% |

| Basel III Total CAR | 19.12% | 17.53% |

* Annualised

9% YOY

9% YOY

12% YOY*

12% YOY*

10% YOY

10% YOY

305% YOY

305% YOY

Strong operating performance, net profit for FY21 at `6,588 crores, up 305% YOY

Q4FY21

FY21

Loan growth driven by all three business segments

Steady growth in stable and granular retail deposits

Well capitalized with adequate liquidity buffers

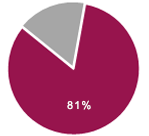

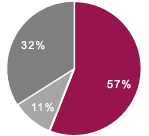

Balance sheet buffers strengthened with high PCR and additional provisions metrics

Bank's domestic subsidiaries delivered strong performance, Max Life stake acquisition completed

* Net Interest Margins

$ Figures of subsidiaries are as per Indian GAAP, as used for consolidated financial statements of the Group

^ Provisions on proforma NPA in Q3FY21, netted from advances for comparability

# Statutory Liquidity ratio

1 Targeted long term repo operations

2 QAB – Quarterly Average Balance

3 LCR – Liquidity Coverage Ratio