Total Assets/Liabilities ` in crores

-

2018-19

-

2017-18

-

2016-17

-

2015-16

-

2014-15

Shareholder’s Fund ` in crores

-

2018-19

-

2017-18

-

2016-17

-

2015-16

-

2014-15

Total Advances ` in crores

-

2018-19

-

2017-18

-

2016-17

-

2015-16

-

2014-15

Retail Advances ` in crores

-

2018-19

-

2017-18

-

2016-17

-

2015-16

-

2014-15

Total Deposits ` in crores

-

2018-19

-

2017-18

-

2016-17

-

2015-16

-

2014-15

Net Interest Income (NII) ` in crores

-

2018-19

-

2017-18

-

2016-17

-

2015-16

-

2014-15

Total Investment ` in crores

-

2018-19

-

2017-18

-

2016-17

-

2015-16

-

2014-15

-

2018-19

-

2017-18

-

2016-17

-

2015-16

-

2014-15

-

2018-19

-

2017-18

-

2016-17

-

2015-16

-

2014-15

Operating Revenue ` in crores

-

2018-19

-

2017-18

-

2016-17

-

2015-16

-

2014-15

Operating Profit ` in crores

-

2018-19

-

2017-18

-

2016-17

-

2015-16

-

2014-15

-

2018-19

-

2017-18

-

2016-17

-

2015-16

-

2014-15

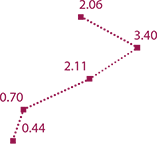

Earnings Per Share (Basic)* `

-

2018-19

-

2017-18

-

2016-17

-

2015-16

-

2014-15

-

2018-19

-

2017-18

-

2016-17

-

2015-16

-

2014-15

-

2018-19

-

2017-18

-

2016-17

-

2015-16

-

2014-15

| |

2014-15 |

2015-16 |

2016-17 |

2017-18 |

2018-19 |

| Return on Equity |

18.57 |

17.49 |

7.22 |

0.53 |

8.09 |

| Return on Assets |

1.83 |

1.72 |

0.65 |

0.04 |

0.63 |

| Capital

Adequacy Ratio |

15.09 |

15.29 |

14.95 |

16.57 |

15.84 |

| Tier - I Capital

Adequacy Ratio |

12.07 |

12.51 |

11.87 |

13.04 |

12.54 |

*2015-16 figures have been adjusted to reflect the effect of sub-division of one equity share of the Bank having nominal value of `10 each into 5 equity shares of

nominal value `2 each.

Previous year figures have been re-grouped wherever necessary. All above figures are standalone.