Our second Integrated Annual Report for fiscal 2025 reflects our untiring commitment to transparency, innovation, and value creation which is open to new possibilities, open to customer aspirations, and open to sustainable progress.

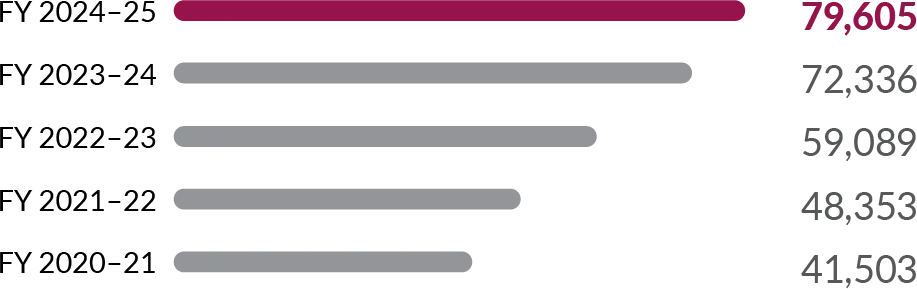

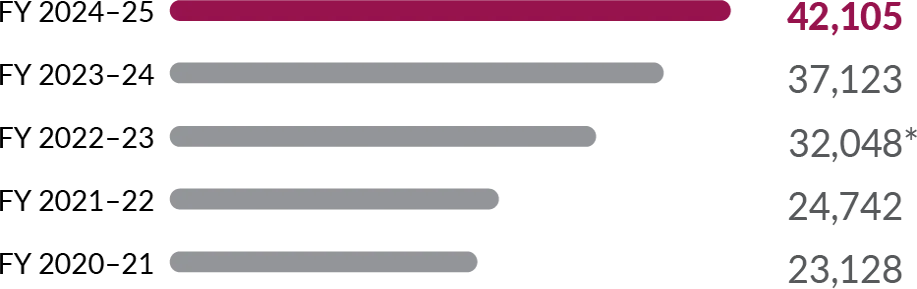

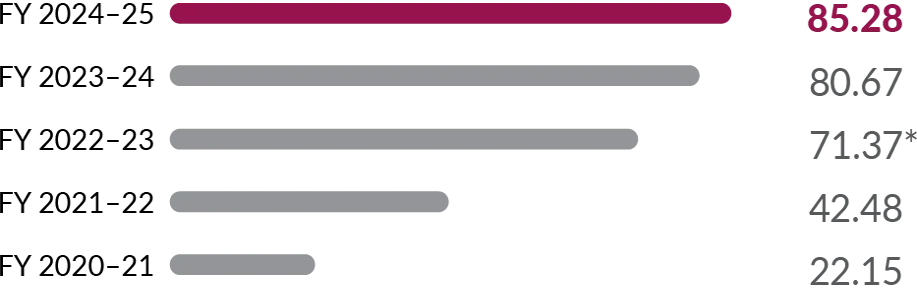

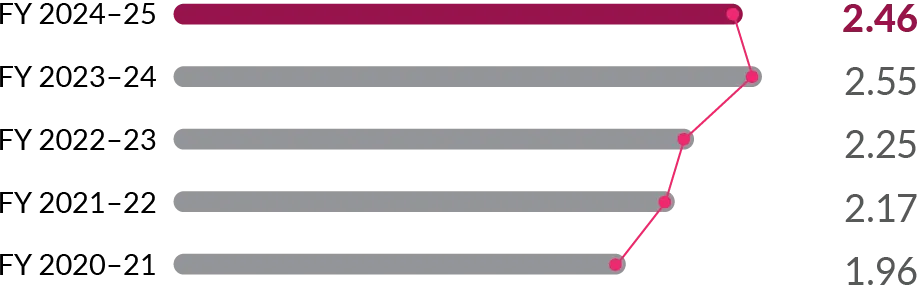

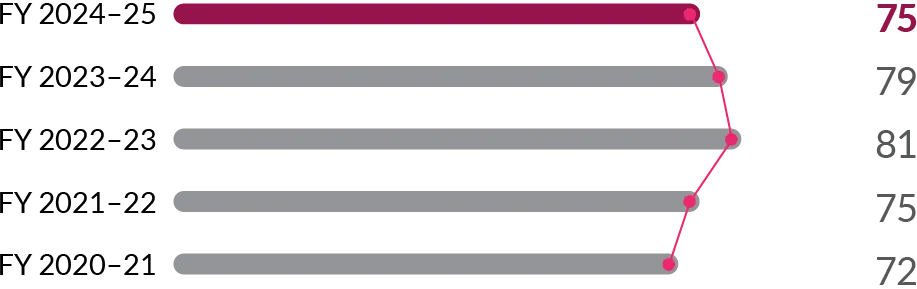

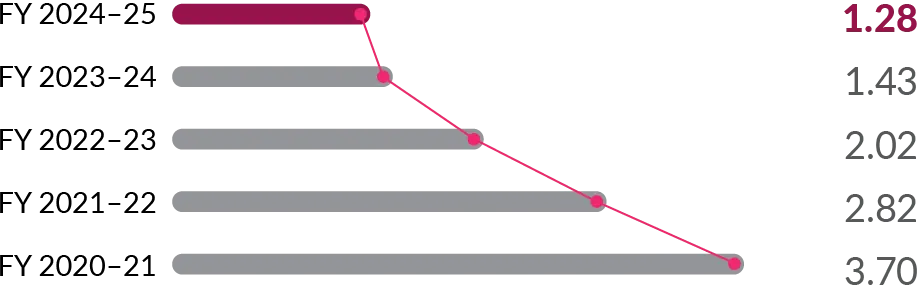

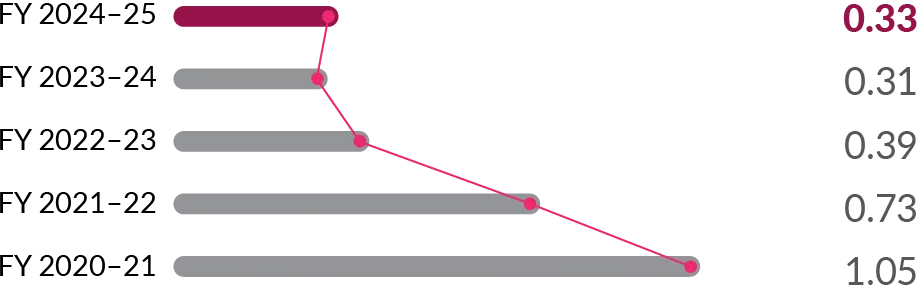

Our financial resilience drives growth, supports responsible lending, and fosters customer-centric initiatives, ensuring sustainable profitability and long-term value creation.

Our vast branch network, digital banking ecosystem, and omni–channel platforms offer a convenient, secure and accessible banking experience anytime, anywhere.

We foster financial inclusion, community engagement, meaningful partnerships, and strengthening trust with customers, investors, regulators, and society.

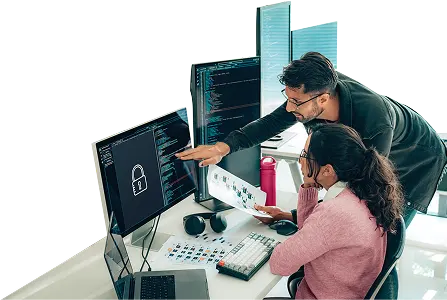

From AI–powered banking to data–driven insights, we harness technology, automation, and intellectual expertise to enhance efficiency, security, and customer experience–staying ahead in the digital era

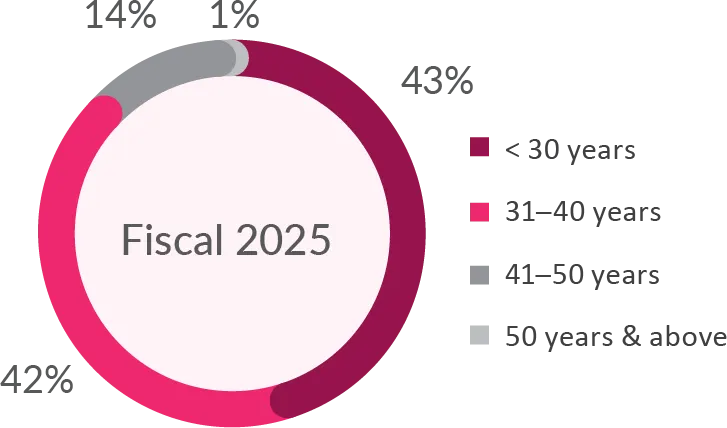

We invest in nurturing talent, fostering inclusivity, and empowering employees to build a future–ready workforce driven by collaboration, agility, and excellence.

We are committed to building a greener, more resilient financial ecosystem through green financing, responsible resource management, and climate action.

The Bank is committed to delivering open, inclusive and future–ready banking. Our diversified and integrated model combines financial strength, innovation and trust to empower every stakeholder on the path to progress.

Explore about Axis BankTo be the preferred financial services provider excelling in customer service delivery through insight, empowered employees, and smart use of technology

Banking that leads to a more inclusive and equitable economy, a thriving community, and a healthier planet

To be the preferred financial solutions provider across the country, delivering customer delight by:

Axis Bank’s integrated business lines offer a comprehensive suite of customised financial solutions to individuals, businesses, and institutions across India. This unified approach leverages digital innovation, domain expertise, and a strong physical presence to holistically serve customers through every stage of their financial journey.

Our retail banking franchise continues to deepen its connection with individuals, small businesses, and Bharat Banking customers by offering a broad spectrum of personalised solutions through digital banking and a robust physical network across India.

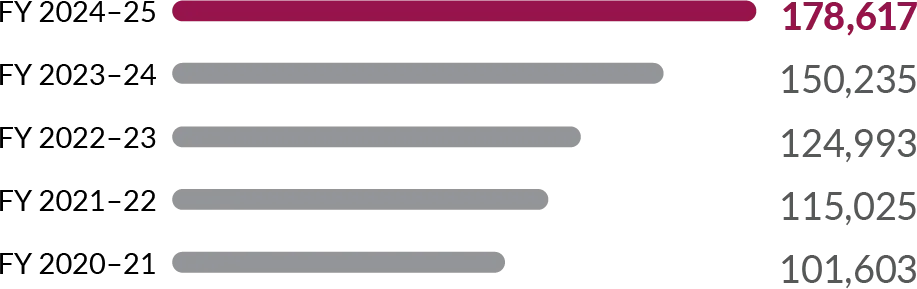

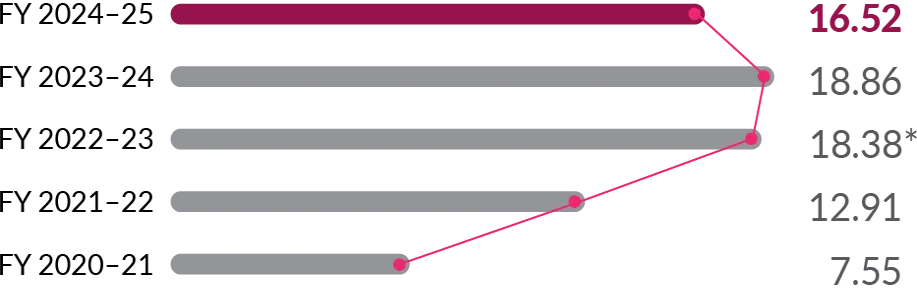

Retail term deposits

Retail loan book

Burgundy Private AUM*

*Includes deposits and assets under advice

We continue to serve Indian corporates and MSMEs by leveraging our domain expertise, transaction banking capabilities, and commitment to digital innovation. Our relationship–led model is built to deliver customised financial solutions at every stage of business growth.

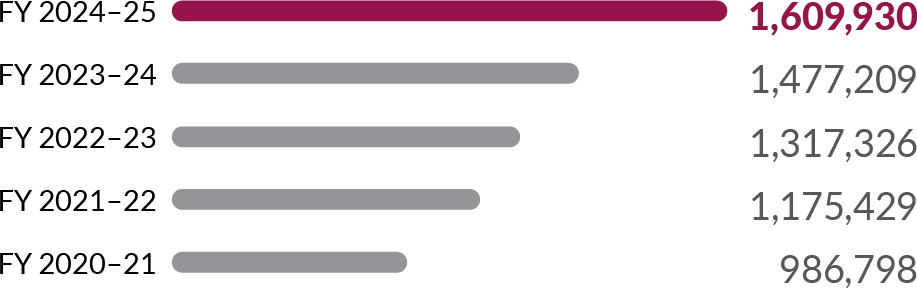

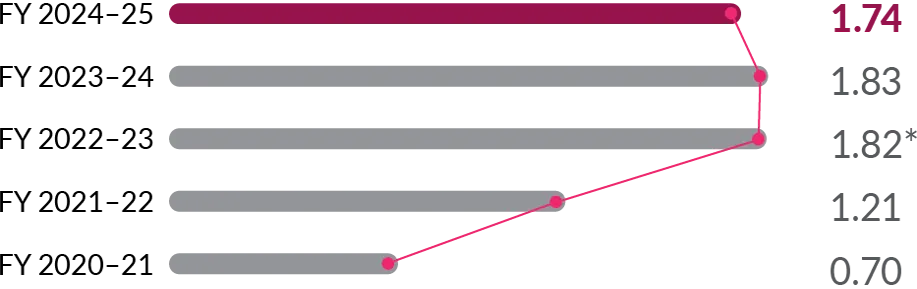

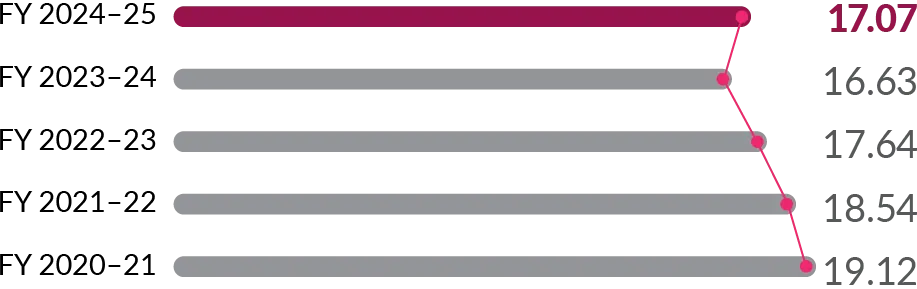

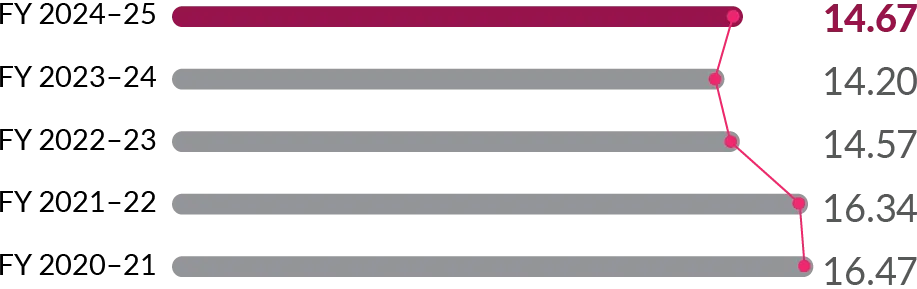

Corporate Loans

Mid–Corporate loan book

SME loan book

‘One Axis’ brings together our full range of offerings across our business segments and subsidiaries, delivering comprehensive and seamless financial solutions. This integrated approach allows us to serve customers holistically — across life stages, business needs, and aspirations.

Total investment in subsidiaries

(as on March 31, 2025)

Combined net worth of domestic subsidiaries (28% y–o–y growth as on March 31, 2025)

Combined PAT of operating subsidiaries (11% y–o–y growth for fiscal 2025)

Dear Shareholders,

It is with great pride and optimism that I present to you Axis Bank’s Integrated Annual Report for the financial year 2024–25. This year has been a year of steady progress, thoughtful transformation, and continued focus on building a resilient and future– ready institution.

N. S. Vishwanathan

Independent Director and Part-time Chairman

Dear Shareholders,

Fiscal 2025 was a pivotal year that showcased our ability to adapt, lead, and innovate in an ever-evolving financial landscape—one that tested our resilience, sharpened our strategic focus, and reaffirmed our commitment to building a future-ready, customer-centric institution.

Amitabh Chaudhry

Managing Director and Chief Executive Officer

Dear Shareholders,

Fiscal 2025 has been a year marked by strategic discipline and thoughtful navigation through a complex operating environment.

Munish Sharda

Executive Director

(Retail Liabilities, Branch Banking,

Bharat Banking, Commercial

Banking Group, and Retail

Portfolio Management Group)

Arjun Chowdhry

Group Executive

(Affluent Banking,

Retail Lending, Cards &

Payments)

Dear Shareholders,

Fiscal 2025 stood out for our Wholesale Banking franchise—one that showcased our ability to lead with client centric innovation and scale with purpose. Our Wholesale Banking franchise is now more agile, digital, and future–ready than ever before.

Rajiv Anand

Deputy Managing Director

Dear Shareholders,

Fiscal 2025 marked an important chapter in our growth as we advanced towards becoming a stronger, more resilient franchise. Anchored by our GPS strategy, we achieved sustained growth and profitability, while simultaneously reimagining and reinforcing the foundation of our organisation.

Subrat Mohanty

Executive Director

(Banking

Operations & Transformation)

Our strategic pillars serve as the foundation for sustained growth, innovation, and stakeholder value creation. Anchored in customer centricity and digital excellence, they guide our journey towards building a stronger, future–ready institution.

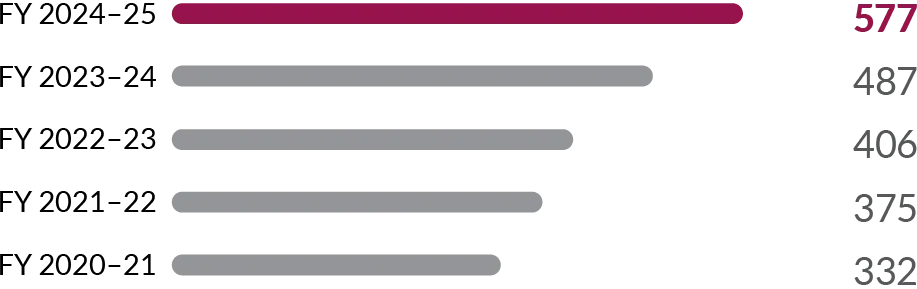

Domestic branches including

extension counters and

3 digital banking units

(previous year: 5,380)

Specialised branches

ATMs and cash deposit/ withdrawal machines

Business correspondence banking outlets

Cities served

(previous year: 2,963)

Districts covered

Districts in India covered by the Bank’s branch and correspondent network

Our extensive network of branches and ATMs spans India’s metros to its distant corners. Through a calibrated expansion strategy and strong presence in rural and semi–urban India, we continue to serve individuals, MSMEs, farmers, corporates and entrepreneurs with customised, locally relevant financial solutions.

Explore presenceThe Bank operates in a dynamic business environment, competing with large private and public sector banks, nimble digital challengers, and non–banking financial institutions. We remain differentiated through scale, discipline, and purpose–led innovation in this fast–moving ecosystem.

Positioned for Progress in a Dynamic Environment

Global Economic Backdrop

Indian Economy & Banking Sector

Regulatory Landscape

The Bank’s Strategic Positioning

Axis Bank creates long–term value by aligning its strategy with stakeholder needs and the priorities of a dynamic, developing India. Our business model transforms financial and non–financial resources into impactful financial products, services, and digital experiences that advance inclusion, innovation, and sustainability. By staying agile, responsible, and future–ready, we continue to generate meaningful outcomes for our customers, communities, employees, and shareholders. This approach not only enhances performance and trust but also reinforces our role in supporting India’s economic and social transformation.

Our Stakeholders

Shareholders & Investors

Regulators and Policymakers

Customers

Industry and Peers

Employees

Value Chain Partners

Community & NGOs

Rating Agencies

Material Issues Linkage

Rooted in our core philosophy of Growth, Profitability and Sustainability, the House of GPS has evolved into a powerful engine that drives us forward. In fiscal 2025, we continued to enrich this strategic framework, enabling us to deliver with distinctiveness while strengthening our digital leadership and execution excellence.

Identified areas of distinctiveness with focus on Customer Obsession ‘SPARSH’ and serving the high growth potential RuSu markets as part of Bharat Banking

Leadership in Digital and Technology to drive productivity, scale and profitability

Structural improvement in quality of earnings with consistent delivery positions us well for the future

Bolstered the Sustainability elements with focus on Executional Excellence, People Proposition , and Operational Risk and Compliance

At Axis Bank, value creation is rooted in sustainable growth that benefits all stakeholders. Guided by our openness to dialogue, our responsibility, and the impact we create, our ESG strategy is anchored in strong governance and shaped by stakeholder priorities.

Explore our ESG agenda

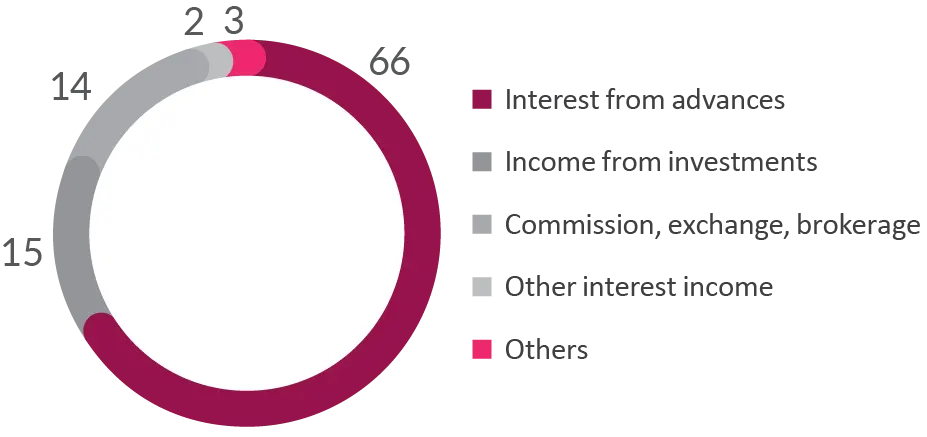

*Excluding exceptional items

Above are standalone figures as on/for year ended March 31, 2025 unless otherwise mentioned

*Excluding exceptional items

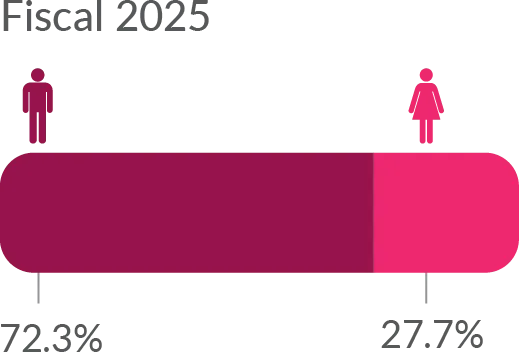

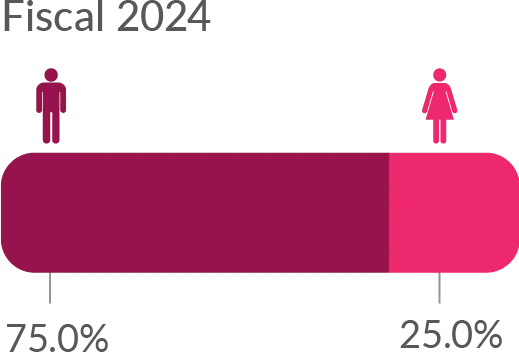

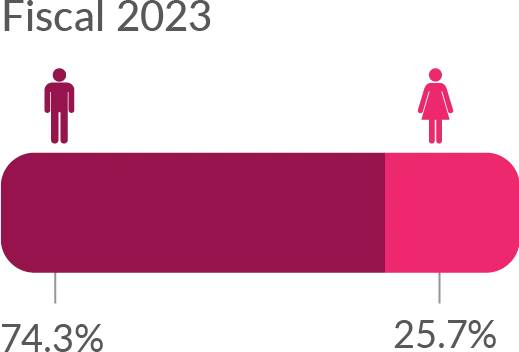

^Out of total women in workforce

*Includes amount transferred to Unspent CSR accounts to be utilised in ongoing programs in subsequent years

#Cumulatively under the Sustainable Livelihoods Program

Powered by our deep customer engagement, continued digital expansion, and a sharper premiumisation strategy, our Retail Banking segment delivered resilient growth across deposits, lending, and payments during the year, reinforcing our position as a trusted financial partner for our customers.

Explore retail banking

Our Wholesale Banking segment supports India’s thriving yet evolving enterprise ecosystem with a solutions–driven approach. Rooted in our belief in openness and collaboration, we remain dedicated to assisting businesses at every stage of their growth journey — whether expanding into new markets, transitioning to sustainable models, navigating complex challenges or supporting mature businesses stay resilient.

Explore wholesale bankingStrong governance is the cornerstone of Axis

Bank’s commitment to integrity, transparency,

and

accountability. Our robust governance framework

ensures ethical decision–making,

effective risk

management, and alignment with stakeholder interests.

By fostering a culture of

ownership and responsible

leadership, we safeguard long–term value creation and

maintain

the trust that is vital to our sustained success.