- Home

- Operating Highlights

Operating

Highlights

Retail Liabilities

- Savings bank deposits crossed `1 lakh crores, growing at a five-year CAGR of 21%.

Technology & Digital Banking

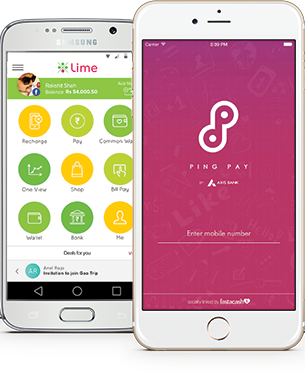

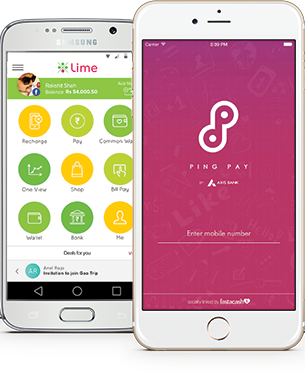

- Ping Pay, India’s first multi-social application launched to enable peer-to-peer transfer of money/recharges through social media platforms like Whatsapp, Facebook and Twitter.

- Launched LIME - India’s first mobile app integrating wallet, shopping, payments and banking.

Retail Payments

- The Bank is one of India’s largest debit card issuers, with a base of over 155 lakhs. On 31 March, 2016, the Bank had over 24 lakhs credit cards in force.

- The Bank is also one of the largest acquirers of point-of-sale terminals in the country with an installed base of around three lakh terminals.

- The aggregate load value on travel currency cards crossed US$6.5 billion during 2015-16.

Network

- Axis Bank was the first private sector bank to introduce recyclers and first bank in India to have 1,000+ recyclers, which can accept and dispense cash. As on 31 March,

2016, the Bank had deployed 1,146 recyclers.

Service Quality

- Overall complaint ratio for the Bank reduced from 1.83 (per thousand accounts) in 2014-15 to 1.75 in 2015-16.

Corporate Banking

- The Bank’s corporate advances portfolio grew by 22% during 2015-16 and stood at `155,384 crores, comprising 46% of total advances.

- The Bank has maintained its leadership position in the loan syndication market and syndicated an aggregate amount of `22,613 crores (previous year `15,930 crores) by way of rupee loans and US$1.93 billion (previous year US$1.55 billion) of foreign currency loan during 2015-16.

- The Bank continues to remain a dominant player in the Debt Capital Market (DCM) Segment. During the year, it arranged `124,136 crores of bonds and debentures for various PSUs

and corporates.

- To make available trade and forex products to all segments of customers, the number of branches handling forex business was increased from 214 to 475 during the year.

International Banking

- As on 31 March, 2016, the total assets at overseas branches stood at US$8.06 billion, compared to US$ 7.86 billion last year.

SME

- ‘SME Dealer Power’ launched during FY 2015-16 offers comprehensive financing facility to the dealers of various companies in the country for efficient management of working capital and other business requirements. Besides, ‘Exim Power’ (launched recently) offers financing facilities to SMEs engaged in export/import activities and showcases the Bank’s commitment towards ‘Make in India’ initiative.

Financial Inclusion

- As on 31 March, 2016, the Bank had a network of 587 rural branches; and more than 31,300 BC agents (spread over 3,272 villages) service the Financial Inclusion customer

base.

- Active in the social security space, the Bank has issued around 8 lakh Pradhan Mantri Suraksha Bima Yojana and 2 lakh Pradhan Mantri Jeevan Jyoti Bima Yojana policies.

Corporate Social Responsibility

- The Bank spent `137.41 crores towards various CSR

initiatives in 2015-16.

↑

CORPORATE OVERVIEW

CORPORATE OVERVIEW

STATUTORY REPORTS

STATUTORY REPORTS

FINANCIAL STATEMENTS

FINANCIAL STATEMENTS

BASEL III DISCLOSURES

BASEL III DISCLOSURES DOWNLOAD CENTER

DOWNLOAD CENTER