You had purchased a second home 10 years back and now are looking to sell it. You found a buyer who is willing to match your rate, and hence you want to close the deal quickly. But before you rush to do so, know what the tax impact will be. Also,

know how you can deploy the profits whereby you can minimise your tax impact.

Note, real estate is classified as a ‘Capital Asset’ [under Section 2(14) of the Income Tax Act, 1961] and therefore, the capital gains made will be subject to ‘Short Term Capital Gain Tax’ or ‘Long Term Capital Gain

Tax’ as the case may be.

If the asset is held for less than 24 months from the date of its acquisition and sold for a profit, then the gain on sale of the asset is referred to as Short-term Capital Gain (STCG). On the other hand, if the asset is sold after holding for

more than 24 months, then the gain is referred to as a Long-term Capital Gain (LTCG) and is subject to an LTCG gain tax.

Keep in mind, other than holding period and tax rates, there is also a difference of ‘Indexation Benefit’ between LTCG Tax and STCG Tax. The Indexation Benefit is applicable only on LTCG Tax and can help to reduce your tax impact significantly

by taking into consideration the Cost of Inflation Index (CII).

Let us understand in detail.

Short-term Capital Tax

To compute STCG, from the Full Value of Consideration received, i.e. the Sale Value, deduct:

(i) Expenditure incurred wholly and exclusively in connection with the transfer

(ii) Cost of Acquisition (i.e. the total cost you had earlier paid to acquire the real estate property)

(iii) Cost of Improvement (i.e. the incidental expenses of capital nature paid by you to make alterations or additions to the property) if any

The remainder will be the STCG. Such short term capital gains are treated like your other regular income and added to your other income. You will have to pay tax as per the income tax slab rates along with applicable surcharge plus health and

education cess applicable for that financial year.

Long-term Capital Gains Tax

To compute your LTCG on the real estate property, from the Full Value of Consideration received, i.e. the Sale Value, deduct:

(i) Expenditure incurred wholly and exclusively in connection with such transfer

(ii) Indexed Cost of Acquisition (i.e. the total cost of acquiring the property minus inflation impact)

(iii) Indexed Cost of Improvement if any (i.e. the incidental expenses incurred to make alterations or additions to the property minus inflation impact)

Note, inflation impact is calculated with the help of Cost of Inflation Index.

The remainder will be the LTCG, with indexation benefit. LTCG is taxed at 20% along with the applicable surcharge, plus the health and education cess.

At a glance

- If property is sold within two years of purchase, the profit is termed as Short Term Capital Gains and you have to pay Short Capital Gains Tax

- If property is sold after two years of purchase, the profit is termed as Long Term Capital Gain and you have to pay Long Term Capital Gains Tax.

- Short Term Capital Gains is added to your income and taxed as per your income tax slab.

- Long Term Capital Gains is taxed at 20% after indexation benefit

- You can claim tax exemption on capital gains by buying or construction another property or investing in specified bonds, under Sections 54, 54F and 54EC.

How to calculate indexed cost of acquisition

What if you have received the property by the way of a gift, will, inheritance, or succession?

If the real estate property is received by the way of a gift, will, inheritance, or succession, then the previous owner’s holding period also be included to determine whether it is a Short-term Capital Asset or Long-term Capital Asset. Accordingly,

you may have to pay either STCG tax or LTCG tax, as the case may be.

Is there is a way to save capital gains from the axe of tax?

Yes, there is. The Income Tax Act, 1961 allows certain exemptions which can help reduce the tax impact.

Section 54: Under this section, you can claim tax exemption by investing the capital gains proceeds to purchase/acquire or construct another residential house in India.

To utilise the benefit of this Section, there are certain conditions. These include:

a) The purchase of the new real estate property should be done either 1 year before the sale or 2 years after the sale/transfer of the original property.

b) If the capital gain proceeds are invested in an under-construction property, the construction must be completed within 3 years from the date of sale.

The amount of exemption that can be claimed under this section is lower of the following:

- The capital gain arising from the transfer/sale of the residential house; or

- The amount invested in the purchase or construction of the new residential house

With effect from Assessment Year 2021-22, the benefit of Section 54 is also available in case of purchase/acquisition of two residential house properties if the amount of capital gain does not exceed Rs 2 crore.

If you sell the new house within three years from the date of purchase of construction, then the capital gain availed under this Section will be taxable in the year of sale of the new house property, the cost of acquisition shall be disallowed

as a deduction, and the property will be subject to capital gain tax.

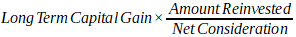

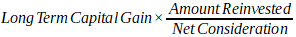

Section 54F: This Section grants full exemption from the capital gain tax on the transfer/sale of any asset other than a house property. However, the following are certain conditions to avail of this exemption:

- The entire sale consideration needs to be invested in a new residential property and not just the capital gains. Moreover, you should not own more than one residential house on the date of transfer/sale of the real estate property.

- The purchase of the new property should be either 1 year before the sale or 2 years after the sale of the property. In case you are investing in an under-construction property, the construction must be completed within 3 years from the date

of sale.

- If you purchase within 1 year or construct within 3 years an additional residential house (other than the new residential house purchased or constructed to claim an exemption under section 54F and have claimed it) from the date of transfer of

the real estate property, then the exemption under 54F will not be available to you. Hence, while availing exemption under Section 54F, you should be careful with the dates of purchasing the new real estate property.

Another point to keep in mind is that if the entire sale proceeds are not invested to claim a full exemption, the amount of exemption you can claim is calculated proportionately as under:

Also note that, if you transfer/sell the newly purchased residential house, within three years from the date of its purchase/acquisition or construction, as the case may be; then the exemption allowed earlier under Section 54F will be reversed

and will be subject to capital gain tax.

Section 54EC: Under this section, you can claim exemption on LTCG from the sale of building or land by reinvesting in specified bonds viz. National Highway Authority of India (NHAI) or Rural Electrification Corporation (REC) or

any other bond notified by the Central Government that redeemable only after 5 years. To avail exemption under this section, here are few aspects to keep in mind:

- The exemption on investment is allowed only against long term capital gains on the sale of the immovable property (i.e. sale of land or building).

- The investment in the aforesaid bonds should be made within 6 months from the date of sale of the immovable property

- Such investment can be redeemed only after 5 years

- The maximum deduction you can claim by investing in bonds is Rs 50 lakh during the financial year

Given that the assessee cannot claim a deduction of more than Rs 50 lakh, only a proportionate deduction is available. So say, the LTCG is Rs 20 lakh (after taking into consideration the indexed cost of acquisition and improvement), but you invested

only Rs 15 lakh; your taxable capital gain will be Rs 5 lakh.

[Also Read: Tax Saving Gifts To Yourself]

What if you incur a loss when selling your property?

If you have incurred a capital loss, you can carry forward and set off the loss against the head ‘Capital Gain’.

The Long-term Capital Loss can be set off only against LTCG, whereas, the Short-term Capital Loss can be set off against both LTCG and STCG.

In case you have not been able to set off the capital losses in the same Assessment Year, you are permitted to carry forward the loss up to 8 Assessment Years, for both short term as well long term loss.

Remember, by applying Indexation Benefit to LTCG, your tax payable may actually work to be much lower. Besides, reinvesting the gains prudently could compound wealth for you.

When you sell your real estate property, weigh all the pros and cons, beware of the tax implications. If you plan well and legitimately, it could save you from the axe of tax.

Disclaimer: This article has been authored by PersonalFN, a Mumbai based Financial Planning and Mutual Fund research firm. Axis Bank doesn't influence any views of the author in any way. Axis Bank & PersonalFN shall not be responsible for any direct / indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information. Please consult your financial advisor before making any financial decision