6 MinsSept 14, 2021

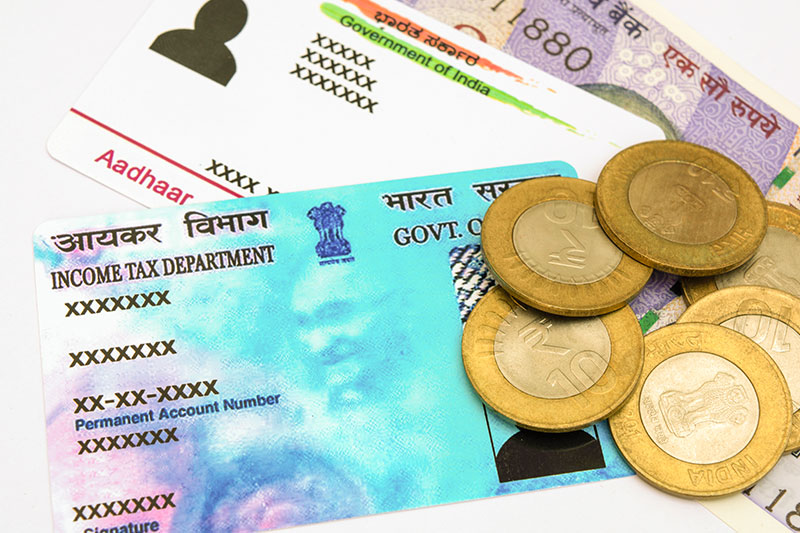

Sujata is a freelance software developer. For the last two months, she has been getting emails from all her clients asking her to ensure that her PAN card is linked with her Aadhaar card. She ignored them until her chartered accountant (CA) also

urged her to link it before she sends out her invoices for her projects, and to do it before end of March 2022.

She asked her CA why it was crucial for both the cards to be linked and was told that the Income Tax Department is making it mandatory for everyone to do so by March 2022.

If PAN and Aadhaar are not linked by the deadline, the PAN card might become inoperative.

Hardships

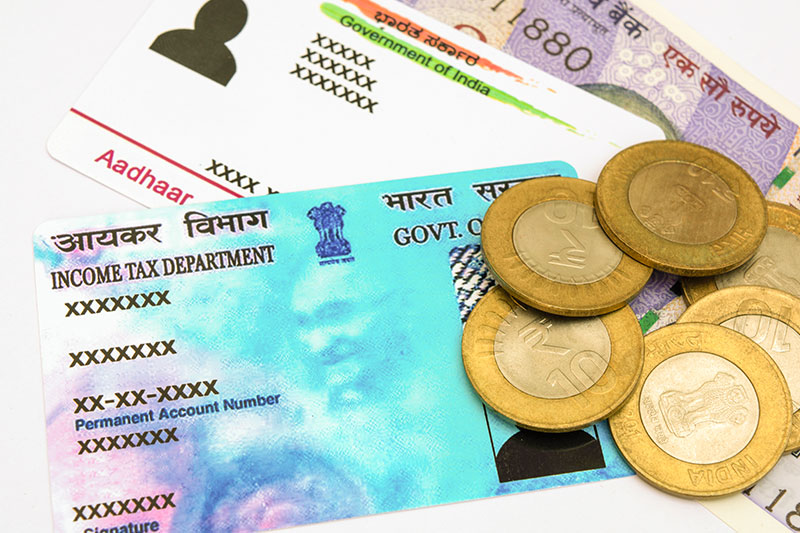

If Sujata doesn’t link the two, she is likely to face several issues in her banking and financial transactions. For instance, TDS (tax deducted at source) will be 20% instead of 10% currently if PAN and Aadhaar are not linked. Also, where

a PAN becomes inoperative, it will be assumed that PAN has not been furnished/quoted as required by the law, and a penalty of Rs 10,000 may apply as per section 272B of the Income Tax Act. Further as per section 234H where a person is required

to intimate his Aadhaar number under sub-section (2) of section 139AA and such person fails to do so on or before such date, as may be prescribed, he shall be liable to pay a fee of Rs. 1000.

In addition to these, several financial transactions also may get impacted if the PAN is not linked to the Aadhaar. Let us see what these are:

Banking transactions that may get impacted:

(1) Opening a bank account: Sujata may not be able to complete her CKYC (Central Know Your Customer) or e-KYC. This may mean that identifying her details and bank accounts will be a challenge for financial institutions. This includes

video-KYC as well, which will affect her in multiple ways. Today it is possible to open a bank account without stepping into a bank branch, or a relationship manager visiting your home. For example, the range of Digital Savings Accounts- a type of savings account - from Axis Bank can be opened from the comfort of your home. But if Sujata does not link her PAN with Aadhaar, she may not be able to open a bank account or conduct any financial transactions. Neither would she be able to apply for a credit

or debit card.

(2) Applying for digital loans:

Instant loans, such as 24x7 Loans, can be availed by applying online, with minimum to no documentation. But without linking her PAN and Aadhaar,

this too will be out of bounds for Sujata. If this were to happen, she would not be able to avail of an instant and digital 24x7 Loans in case she needs funds in an emergency. With the festive season around the corner, there are chances that

she may need money for some last-minute shopping or repairs to her home.

(3) Making payment via cheques and bank drafts:

She may not be able to purchase bank drafts, pay orders or banker's cheques in cash for an amount exceeding Rs 50,000 on one day.

Investments:

Sujata may not be able to open a Demat Account (which in turn means she won't be able to invest in stocks), buy debentures or bonds from any institution

for over Rs 50,000 or subscribe to Reserve Bank of India bonds for over Rs 50,000.

Payments:

Payment of over Rs 50,000 at any hotel or restaurant in cash at one time, or for foreign travel may get impacted if Sujata does not link her PAN with her Aadhaar. She also may not be able to buy or sell any vehicle

which is not a two-wheeler.

To know more about linking your PAN with Aadhaar and how to do it, click here.

Axis Bank has been sending repeated reminders to all its customers to link their PAN numbers with Aadhaar. If you haven't done it already, please do it before September 30 to avoid hardships.

Disclaimer: The Source, a content creation and curation firm has authored this article. Axis Bank does not influence the views of the author in any way. Axis Bank and The Source shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information. Please consult your financial advisor before making any financial decision.