2 MinsApril 20, 2020

Repaying a loan may be the last thing on your mind if you are facing any kind of financial stress.

But missing an EMI or defaulting on your loan can have a long-term impact. The negative impact

stays on your credit report for two to three years

and can affect your chances of borrowing in the future. Hence, you must not miss a single

repayment.

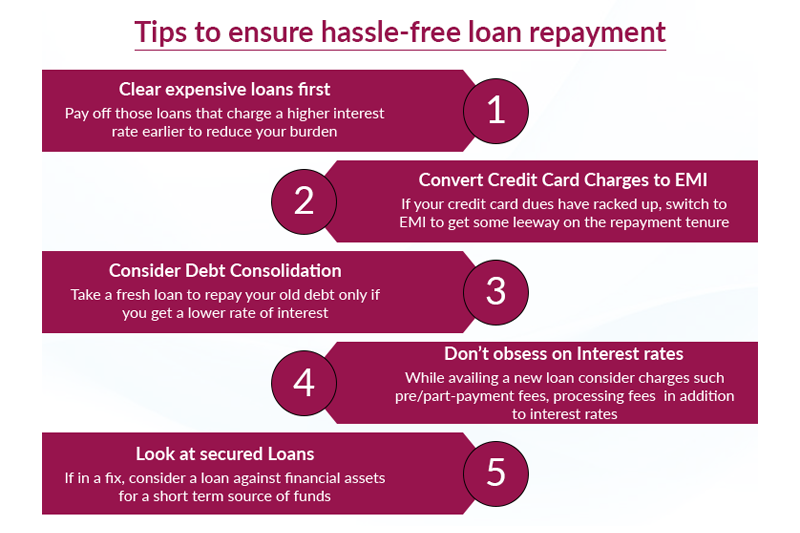

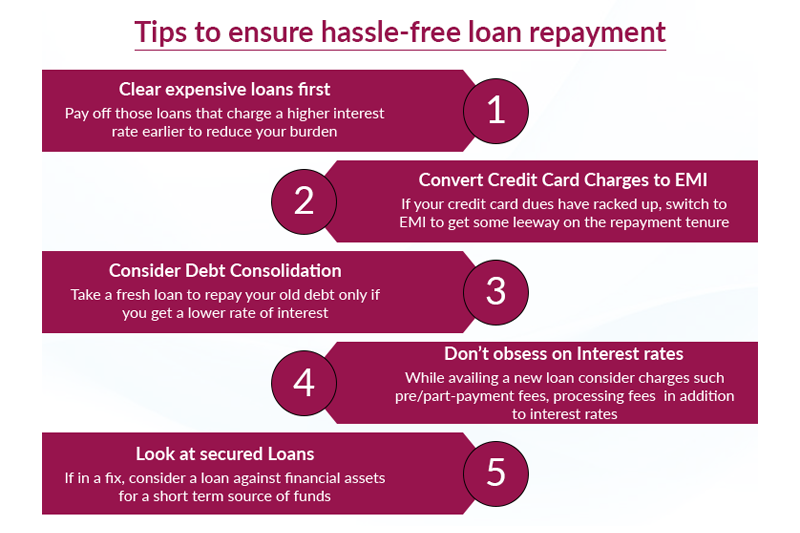

If you are facing a cash flow problem here are a few things to keep in mind.

1. Pay off expensive loans first

If you have more than one kind of debt, say

credit card outstanding and personal loan and are finding it difficult to repay both

simultaneously, pay off the more expensive loan first. While

both are unsecured loans, the interest rates on credit cards can be as high as 40-45%, depending

on the tenure. While for a Personal

Loan the rates range between 12 and 24%.

You may be tempted to pay off your personal loan as it could be of a longer duration than your

credit card dues. But remember, the interest charges on credit cards can add up to a tidy sum if

left unpaid.

2. Convert credit card outstanding into EMI

If you have run up a huge credit card outstanding you can convert it into an

EMI and repay it monthly. In this case, the rate of interest

will be lower than if you only pay the minimum amount due and carry forward the remaining

outstanding. The bank will also charge you a processing fee for converting the outstanding into

EMI and your credit card limit will be reduced to that

extent until it is paid off in full.

3. Consolidate your debt

Taking a fresh loan to repay an existing loan may not

seem like a good idea. But if your cash flow is under stress, this could be a good option. You

can either transfer your credit card balance to

another card which charges a lower rate. Or you could avail of a personal loan and repay your

credit card loan since the interest rates on personal loans are lower.

[Also Read: Things

to Know Before You Prepay Your Home Loan]

4. Compare all costs and not just interest rates

When you avail of a personal

loan, check the charges on pre-payment and processing fees in addition to interest rates, as

these will also add to your cost. The bank where you

have your salary account may offer you a loan faster, as you may not need to undergo the

verification procedure. But do compare both cost and convenience before zeroing in on the bank.

For instance, Axis Bank does not charge a pre-payment

penalty on personal loans.

5. Look at secured loans

You can even look at a loan against FD and other financial investments such as Debt

or Equity Mutual

Funds, Equity Shares, Listed Bonds, Life Insurance Policies and gold. These being secured loans,

the interest rates are lower than on personal loans,

in the range of 10 to 14%. Besides, you won't need to sell or redeem your investment completely.

But if you need a large amount, these loans may not be suitable as the amount is restricted to a

certain percentage of your investment value.

Keep track of your loan repayment by checking your credit score and report regularly. You can get one

free credit report from the credit bureaus in a year. Use this facility to your advantage to

maintain your track record.

Disclaimer: This article is for information purpose only. The views expressed

in this article are personal and do not necessarily constitute the views of Axis Bank

Ltd. and its employees. Axis Bank Ltd. and/or the author shall not be responsible for

any direct / indirect loss or liability incurred by the reader for taking any financial

decisions based on the contents and information. Please consult your financial advisor

before making any financial decision.