5 minsJanuary 1, 2019

If you are looking at saving on the interest cost while you aspire to purchase, construct, or even renovate your dream home on a loan, here’s some good news for you.

Axis Bank has launched a first-of-its-kind home loan offering, called ‘QuikPay Home Loan’ that will enable you to save a substantial amount as interest

outgo.

- How?

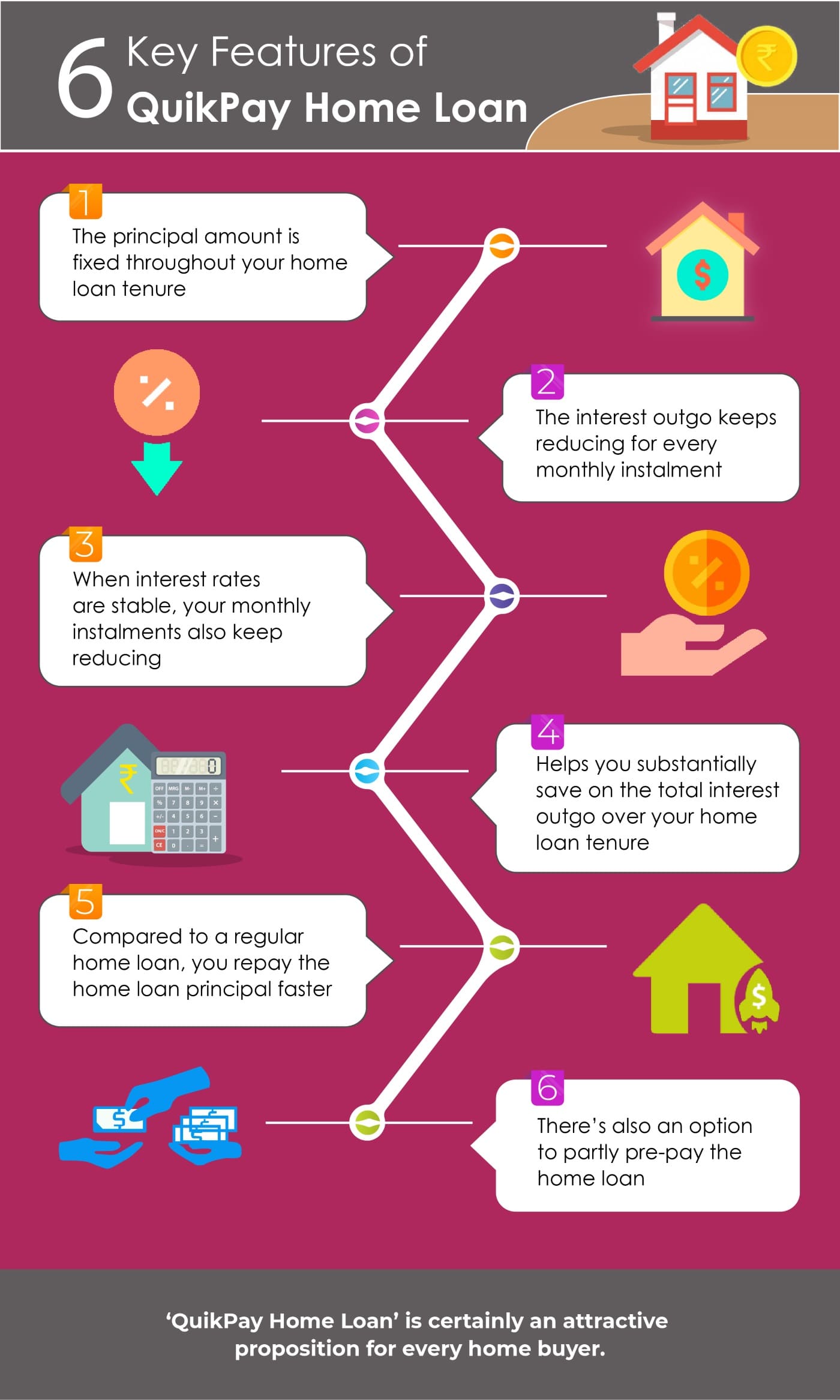

- As against the industry norm, ‘QuikPay Home Loan’ offers an alternative repayment structure, where you repay an equal amount of the principal, i.e. a fixed amount every month along with interest on the outstanding balance.

Thus, the equated fixed principal amount combined with reducing interest amount of your home loan results in a reduction of monthly instalments over the tenure of your home loan.

- ‘QuikPay Home Loan’ is unlike a regular home loan, where the Monthly Instalments reduce every month. With the change in interest rate, your Monthly Instalments will increase or decrease, while the loan tenure will remain

constant.

- How much will you save by opting for a ‘QuikPay Home Loan’?

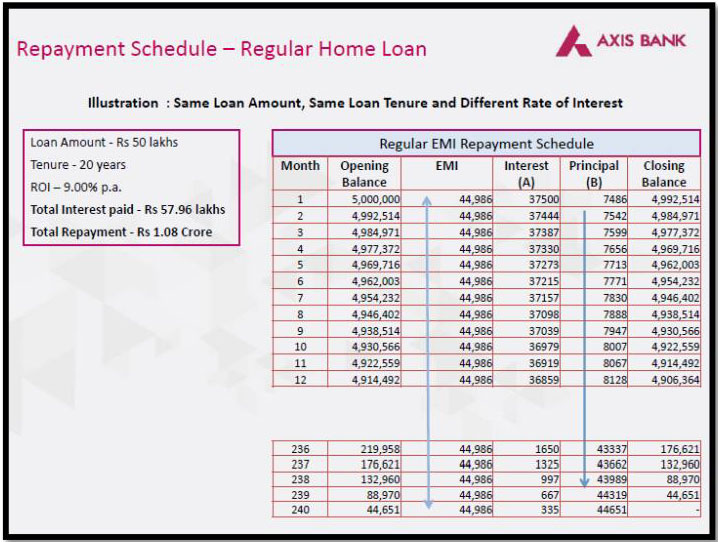

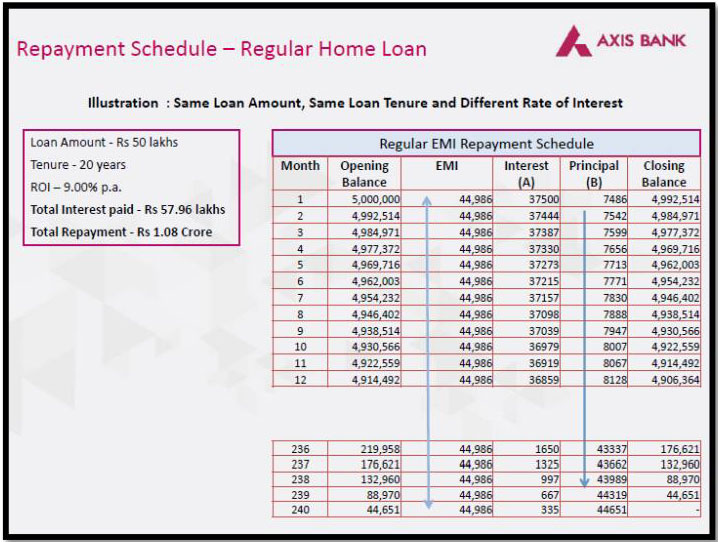

- Say, you opt for a typical or regular home loan to the tune of Rs 50 lakh @ 9.00% p.a. for 20 years tenure. In this case, the math works out as illustrated in the table below:

- As you can see in the table, although the EMIs will remain the same throughout your home loan tenure, the total interest outgo will amount to Rs 57.96 lakh, and therefore your total repayment Rs 1.08 crore. Remember, these figures

could go up if the interest rates on your home loan moves up.

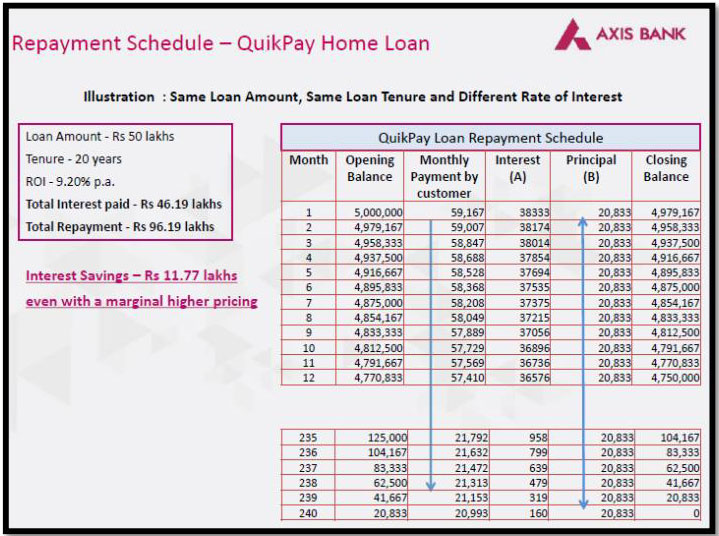

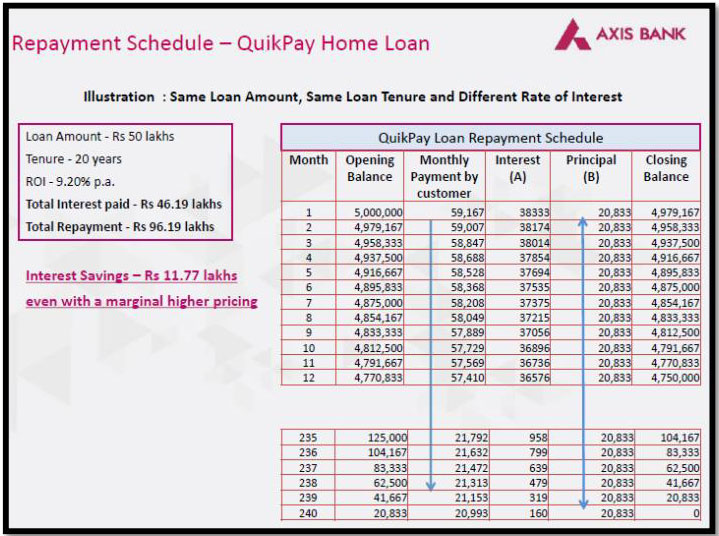

- On the other hand, if you opt for a ‘QuikPay Home Loan’ worth Rs 50 lakh for the same loan tenure, and even if the interest rate increases to 9.20%, you stand to benefit. Here’s how the math works:

- In the case of ‘QuikPay Home Loan’, the principal repayments remain fixed and the interest outgo reduces over the tenure of the home loan. As exhibited by the table above, the total interest outgo under ‘QuikPay

Home Loan’ stands reduced to Rs lakh 46.19 (compared to 57.96 lakh in case of a typical regular home loan). Therefore, you stand to gain by saving Rs 11.77 lakh even with a marginally higher rate of interest.

- You can also partly prepay the home loan. There are no charges for part prepayment or foreclosure on floating rate home loans. The monthly instalment will reduce on making a part prepayment along with the total loan outstanding.

But instead of lump sum prepayments, you can simply pay a higher principal each month and save on total interest paid to the bank. That’s the very essence of ‘QuikPay Home Loan’

So, ‘QuikPay Home Loan’ is certainly an attractive proposition for every home loan buyer.

- The loan can be availed to purchase the house (irrespective whether ready, resale, or under construction), to construct a new house, for an extension or renovation of the house, and even for transferring your existing home loan

from another bank / financial institution to Axis Bank. Use Axis Bank's home loan EMI calculator to know how much you can save for a QuickPay home loan..

Apply for ‘QuikPay Home Loan’ today and accomplish your goal of buying a dream house.

Also Read: [What is an instant home loan top-up]

Disclaimer: This article has been authored by PersonalFN, a Mumbai based Financial Planning and Mutual Fund research firm. Axis Bank doesn't influence any views of the author in any way. Axis Bank & PersonalFN shall not be responsible for any direct / indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information. Please consult your financial advisor before making any financial decision.