7 MinsJune 24, 2020

As individuals we all have personality traits and quirks that make us unique. What works for one may not work for another. The same applies to investing. There is no one size that fits all. Before you start your investment it is important to understand

what your risk profile is and draw up a financial plan based on that. Let us see how you can determine what is your risk profile and what type of an investor you are.

What is an investor risk profile?

A risk profile is the ability and willingness to take risks while investing. This ability to take risk is generally determined by factors like:

- Personal factors: Age and attitude to life

- Financial factors: Size of income and its regularity, existing capital base

- Family Situation: Number of earning members, family income-expense ratio, number of dependents

- Investment horizon: the amount of time you have to keep your money invested

A younger person might invest in riskier instruments such as equity as she may have a longer time horizon to realise her goal which means that she can stay invested for longer and ride out the interim volatility to generate better long-term returns.

As against this, someone who is closer to retirement and needs a fixed amount of money within a shorter period of time, cannot afford to lose money in the ups and downs of equity market cycles. Fixed income investments are better suited for

such an investor.

Similarly, if you have a high salary you may be more comfortable with investing a larger portion in equities in an attempt to earn higher returns. However, someone whose income is not regular and spends a larger portion of the income for regular

expenses, may prefer instruments that offer more stable and predictable returns, even if it is on the lower side.

Just because one has a large capital base with few liabilities doesn’t mean they are willing to take on higher risk. Preserving capital might be more important to them and hence, they may choose to invest in low risk assets and play it safe.

[Also Read: How you can formulate your investment strategy]

The correlation between risk and return

A fundamental rule of investing is that rewards and risks go hand-in-hand. Safer investments give lower returns, but there is a much lesser chance of capital erosion. Riskier investments may give higher rewards, but there is always a greater chance

of loss.

To illustrate: A fixed deposit with a bank will give 3-6% return per annum (depending on tenure and size of the deposit). But the chances of an investor losing money are minimal.

Investing in an equity mutual fund may get you 12-15% returns if invested for longer time horizon. On the other hand, your returns may decline if invested for a shorter time frame as equity markets are volatile.

Within equities as an asset class also there is a difference between risks and returns associated with investments in large-cap, mid-cap and small-cap companies. Since large-cap companies are more mature companies they tend to have relatively

stable growth and return profile. A mid-cap or a small-cap company may give higher returns but the risks associated with them are also much higher, which are seen in higher stock price volatility. Hence, large-caps within equities are relatively

less volatile because in market downturns investors tend to shift their investments to quality and relatively safer investments as they become risk averse.You need to keep this in mind when choosing which companies to invest in.

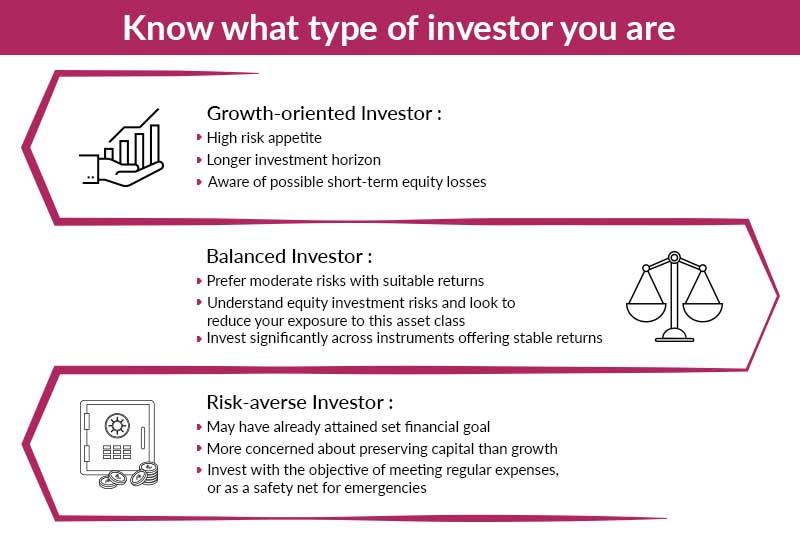

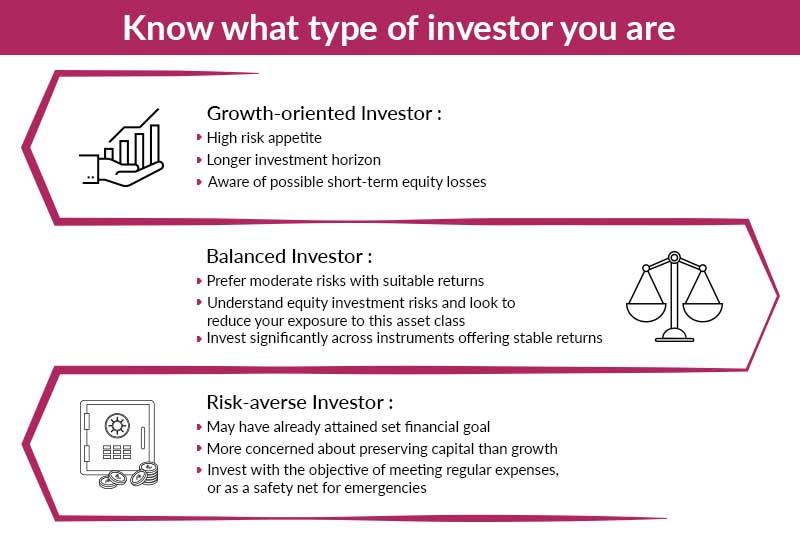

With this thumb rule in mind, listed below are brief descriptions of different kinds of investors and investment options that they could consider.

Growth investors

- These investors understand that the stock market is volatile. They are aware that there is a risk their returns may decline in the interim, but that there is also a strong possibility that they could make good the losses given the long-term

nature of equity investments.

- Typically, these are investors who have an appetite for higher risk and/or whose goals are some time away and hence have time to stay invested, which will help address the volatility in the equity returns.

- These investors may consider a mix of large-cap companies and mid-cap companies and mutual funds focused on these segments. They may even consider investing a smaller portion in debt funds or fixed deposits, to mitigate some risk.

Balanced investors

- These investors prefer a balance between risk and returns. They understand that equity investments carry higher risks and would like to reduce their exposure to this asset class by making significant investments in instruments that offer stable

returns and also carry lower risk.

- Those who have expenses such as home loan EMIs or have dependents such as senior citizen parents, may fall in this category. Their aim could be to earn enough returns to meet their expenses which are long-term and may also be unpredictable

in nature.

- Such investors may consider a mix of large-cap mutual funds, balanced funds, debt funds and fixed deposits.

Risk-averse investors

- These investors are concerned about preserving their capital, more than earning returns.

- One reason could be that they have attained their long-term financial goals and are now looking for sufficient returns to meet their regular expenses, with a small safety net for any emergency.For instance, those nearing retirement could fall

in this category.

- It would be advisable for such investors to consider balanced funds, debt funds and fixed deposits as these have relatively lesser risk.

Please remember that there are no 'Right' or 'Wrong' kind of investors. Each investor is unique, based on his/her risk profile. Your profile may also change as your goals change. For instance, if you repay your home loan, you may decide to invest

a higher portion in equities to earn higher returns. Or if you or your spouse lose your job and your family income is reduced, you may decide to adopt a more conservative stance for investing till such time as your family income increases

again.

Please note that the categories listed above and the investments suggested are only broad guidance. Consult your financial advisor or your Axis Bank relationship manager to develop a more personalised understanding of your risk profile before

making any investment decisions.

Disclaimer: This article is for information purpose only. The views expressed in this article are personal and do not necessarily constitute the views of Axis Bank Ltd. and its employees. Axis Bank Ltd. and/or the author shall not be responsible for any direct / indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information. Please consult your financial advisor before making any financial decision

Mutual Fund investments are subject to market risk, read all scheme related documents carefully. Axis Bank Ltd is acting as an AMFI registered MF Distributor (ARN code: ARN-0019). Purchase of Mutual Funds by Axis Bank’s customer is purely voluntary and not linked to availment of any other facility from the Bank. *T&C apply