4 MinNovember 08, 2023

The Indian automobile market has indeed come a long way in the past 70 years. In the 1950s, the annual automobile production was limited to 40,000 units. In 2022, we eclipsed Japan in auto sales by securing the third position in the world. Thus,

one thing is sure – there is no turning back for the country! Moreover, India is not far behind in the Electric Vehicle (EV) boom, taking centre stage in major global economies.

Key Statistics at a Glance

- The EV sales in India surpassed the 1 million mark in less than nine months in 2023. The current electric (BOV) vehicle registration year-till-date stands at 11,35,480 (as of 12th Oct 2023).[1]

- An IEA report released in April 2023 suggests that more than half of three-wheeler registrations in India in 2022 were electric.[2]

- According to the McKinsey India Mobility Consumer Survey, in Dec 2022, most people in India are planning for EVs for their next car purchase, where full battery electric vehicles (49%) have the edge over plug-in hybrid EVs (21 per cent).[3]

- A McKinsey report also estimates the EV market penetration in the country to grow 10 to 15 per cent by 2030, creating extensive opportunities for all the stakeholders.[4]

- Economic Survey expects that the Indian EV market will get the 1 crore units annual sales mark by 2030.[5]

India's ambitions target for the EV Sector

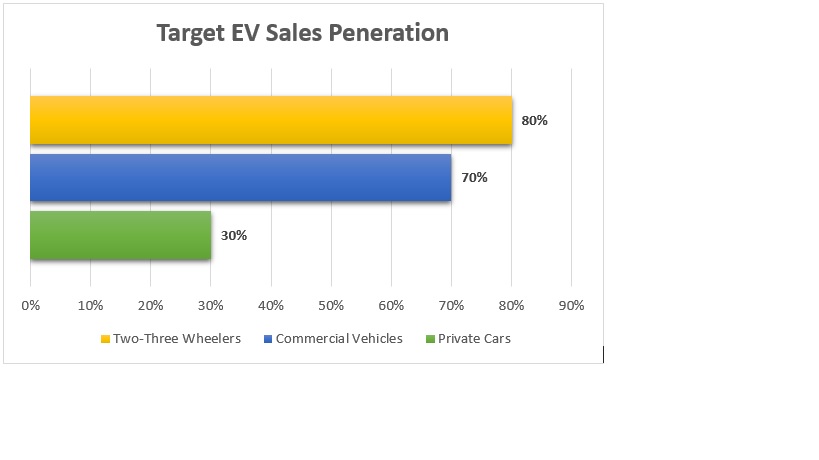

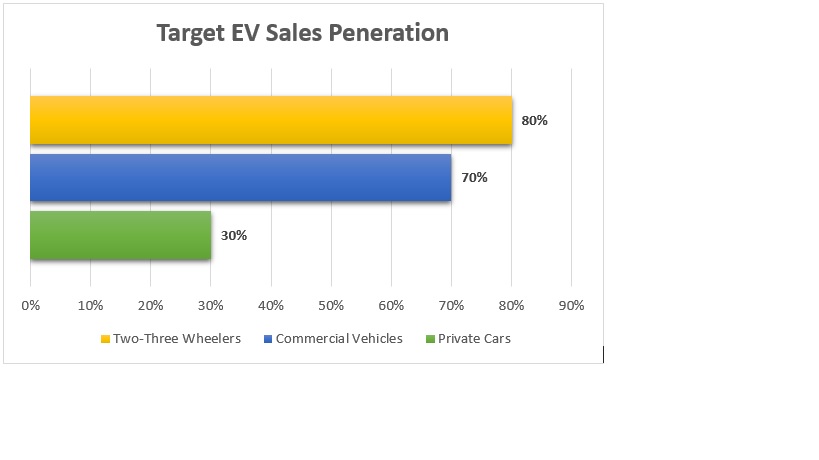

The Government of India aims to achieve 100% local production of EVs under its 'Make in India' initiative. Additionally, Mr Nitin Gadkari, Road Transport and Highways Minister, aims that by 2030, India's EV market is expected to grow to ten million

units annual sales and create 50 million jobs. The target EV to fuel-based car mix in India by 2023 is represented below:

Government initiatives to achieve the target

To achieve the target and ensure the rising consumer demand for EVs is met, the government announced several initiatives.

- National Electric Mobility Mission Plan (NEMMP): This government policy aims to reduce the country's dependency on crude oil by promoting hybrid and electric vehicles.

- Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles (FAME) and FAME-II: This scheme incentivises buyers and manufacturers of hybrid vehicles and EVs to make the product more accessible and affordable. The current phase is

valid till 2024.

- Production Linked Incentive (PLI) Scheme: The scheme is developed especially for the automobile and auto component industry and provides financial incentives to boost domestic production of ACC batteries and other components.

- No Custom Duty: The Union Budget 2023 has withdrawn custom duty on capital goods/machinery to manufacture lithium-ion cells for use in electrically operated vehicles (EVs) batteries.

- Nationwide EV Policies: Of the 28 Indian states and 8 Union Territories, 26 have released EV policies. Amongst them, Maharashtra, Delhi, Uttar Pradesh, Haryana, and Punjab offer the most comprehensive ones.

EV Market in India – The way forward

India's nationwide transition to electric vehicles can be a turning point for the country and the world. Some of the essential aspects to know in the EV sector are:

- Most of India's electricity is produced by burning coal, and if the same continues, it defeats the whole purpose of an electric and eco-friendly vehicle. Hence, the government is exploring ways to pursue research and development for better

alternatives.

- According to a press release by the Ministry of Heavy Industries, there are 6,586 operational Public EV charging stations in India vis-à-vis China, which has a network of around 1.8 million public charging stations. Also, considering

the EV target and demand, there is a huge requirement to fill the gap. The government is working with the private sector to boost the presence of stations and also create a system to monitor the charging process.

- Batteries are the most crucial component of an EV. The government is encouraging private players to create lightweight batteries with higher energy density, use renewable charging sources, and offer them tax credits.

How corporates can benefit by investing in an EV company?

Electric Vehicles are surely the way forward, even in Indiana markets. Although the government is taking a lot of initiatives to ensure the country becomes more environmentally responsible by way of EVs and to make them more affordable to the

end consumer, investments from all corners will push the envelope.

- Corporates can have exposure to a wide range of EV assets and not limit themselves solely to automakers.

- Investing in related components like battery manufacturers, tech companies developing the communications and companies undertaking charging systems requirements by EVs offer great investment opportunities.

- There is ample support from the government, including tax credits, incentives and subsidies.

- The growing demand in the EV and allied sector offers a good chance of long-term growth.

- Lastly, investors can feel good about their money, creating a more sustainable world.

Wrapping Up

Corporate players are vital in offering intelligent solutions and financial support to the EV industry that can contribute to infrastructure development. They can also act as a bridge between government agencies and end-users in transforming the

country's transportation landscape.

[Also Read: Reasons you should opt for an Electric Car]

Citations:

[1] https://vahan.parivahan.gov.in/vahan4dashboard/

[2] https://www.iea.org/reports/global-ev-outlook-2023

[3] https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/consumers-are-driving-the-transition-to-electric-cars-in-india

[4] https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/consumers-are-driving-the-transition-to-electric-cars-in-india

[5] https://www.indiabudget.gov.in/economicsurvey/

Disclaimer: This article is for information purpose only. The views expressed in this article are personal and do not necessarily constitute the views of Axis Bank Ltd. and its employees. Axis Bank Ltd. and/or the author shall not be responsible for any direct / indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information. Please consult your financial advisor before making any financial decision.