3 minsJune 19, 2017

“I’m too worked up these days - juggling between my business and the constitutional duty of paying taxes. Now I’m rushing to my Chartered Accountant’s (CA’s) office to set things right on my tax filing.

According to my CA, I’m liable to pay a large sum as Income-tax, despite having made all necessary tax saving investments. I’m wondering how I can lower my tax outgo.

So, if you don’t mind, can we talk regarding wealth planning a little later, please?” – This is the response one of our relationship managers got last year while speaking to his client; who was about to opt in for our advance

wealth management service.

It is time of the year, when many of you may be rushing to your CA’s office with all the requisite documents to file your Income-Tax (I-T) returns. And you would agree that as the last date of filing approaches, the heat is felt even more.

You see, paying taxes is not only your legal responsibility but also a moral duty. It earns for you the dignity of consciously contributing to the development of the nation. Also, Income-Tax (I-T) returns validate your credit worthiness before

financial institutions…and that can help you in accessing many financial benefits such as bank loans, credit cards and much more.

Taxing times are here again. Yes, it’s that time of the year when you have to file your I-T returns.

Income-Tax Deadlines

July 31, 2017

Due date for filing annual return of income for the assessment year 2017-18 for all assessees other than –

(a) corporate-assessee; or

(b) non-corporate assesse, whose books of account are required to be audited; or

(c) working partner of a firm whose accounts are required to be audited; or

(d) an assessee who is required to furnish a

report under section 92E

September 30, 2017

Due date for filing annual return of income for the assessment year 2017-18 if the assessee is –

(a) corporate-assessee; or

(b) non-corporate assessee (whose books of account are required to be audited); or

(c) working partner of a firm whose accounts are required to be audited)

So don’t delay; because not filing your I-T returns on time can attract penalty, interest …plus you would not be allowed to make any amendments to your I-T returns in case of errors. It would also preclude you from carrying forward

your losses and adjust it from your future gains.

Besides, not filing your I-T return on time can bring along other peril such as:

- Risk of prosecution under the relevant provisions of the Income-Tax Act, 1961 which may also lead to imprisonment from 6 months to 7 years plus the fine

- Impediments in obtaining bank loan or even a credit card (as I-T returns often validate your credit worthiness before financial institutions)

- Impediments in your visa application approval, if you have plans to travel abroad

- Problems in registration of immovable property

Therefore, we strongly recommend that you file your I-T returns on time and always make sure that you pay your taxes before the due date.

We recognise that you are busy in your economic activity, trying to make a living. But paying tax timely is a constitutional responsibility which you should abide by. Further, in the endeavour to earn a higher disposable income it is pointless

playing ‘hide and seek’ with the tax authorities, as there are chances of getting caught and facing prosecution. Mind you, after the demonetisation move of the Modi-led-NDA Government, tax authorities have intensified their vigil.

[Also Read: Income Tax Slabs for 2020-21]

It is noteworthy that filing I-T returns early or before time has several benefits…

- Enough time to get all your documents in order:

- You would agree that the time required to put all the vital documents in order can’t be underestimated, especially when you are self-employed running a business or profession. There are a host of documents – interest certificates,

loan repayment statements, TDS certificates, Form 26AS, updating books of accounts, etc. – which all needs to be furnished to the Tax Return Preparer (TRP) or your CA on time to compute the effective tax liability. By starting

your income-tax preparation early, you will have enough time to request for these documents from the bank or from the appropriate sources.

- Enough time to root out error

- Given the fact that determining liability is an exhaustive task, giving enough time to the TRP or CA is imperative for them to do judicious and proficient job. Near to due date, TRPs and CAs are flooded with work, hence, they may not

give sufficient time to your case. As a result there are possibilities of errors. In a haste to meet the deadline, forgetting to include certain sources of income or miss claiming a deduction is probable. Hence, it is sensible

to file your I-T returns on time. For revised returns, please note that the deadline has been reduced. From the AY2018-19, the deadline for filing revised returns will be March 31, 2019.

- Faster processing of returns:

- You will clearly avoid the last minute technical err. Often server slowdown due to several requests closer to the tax filing deadline can be annoying and consume a greater processing time. So as far as possible, avoid the deadline

rush and file your taxes early.

- Quicker refunds:

- If you have a tax refund, your I-T return may get processed faster provided you file your claim in advance. Refund processing usually takes more time than processing forms with a tax due. If you file your IT-Return later, the tax refund

may get delayed due to the rush.

Plus, don’t ignore the opportunity cost. If your tax refund is a sizeable amount, you can put it to productive use early and reap gains. The longer you delay, means missing out on higher interest that could be earned

on the amount. Further, if your refund amount is greater than 10% of the tax payable, you are paid an interest @6% p.a. calculated from the date of filing the return. You will lose this benefit if you file the returns after due

date.

- Faster processing of loans, visa, credit cards:

- I-T returns acts as a proof of the income you earn. It may be a mandatory document for processing loans, visas and your credit card application. With interest rates falling, home loans are now becoming viable. Therefore, if you plan

to apply for a home loan, it is pertinent to have all your income proofs ready.

- Opportunity to learn from the mistakes and undertake better tax planning:

- Filing your I-T returns early will provide you an opportunity to learn from your past mistakes. Your CA can provide you with interesting insights onto what you should be doing in the new financial year to facilitate legitimate and

prudent tax planning.

As the I-T rules change, you’ll have sufficient time to comprehend the bearing on your personal finance. For example, post-increment or even otherwise, a salaried individual can potentially reach out to the HR department

of the organisation to optimally restructure the salary, whereby the tax outgo can be minimised pursuant to the change in tax provisions and tax rules applicable for the respective assessment year.

- Eliminates stress:

- You would agree that life today, is quite taxing. Stress is drawn in from all corners and can jeopardise your financial wellbeing and your health. So, ideally avoid adding the stress missing the due date and being charged a late fee

and penal interest. By submitting your tax returns before the deadline, you will be happier person and enjoy host of benefits from banks and other institutions.

Today, e-filing of I-T returns is mandatory for individuals,

HUFs and many other assessees subject to certain conditions.

Moreover, Aadhar is a must today to file I-T returns. Correspondingly, vide an amendment in the Finance Act, 2017-18 Section 139AA has been introduced to the Income-Tax Act, 1961 making it compulsory for

all assessee to link their Permanent Account Number (PAN) with Aadhaar. The honourable Supreme Court in the recent judgement has made it mandatory for taxpayers i.e. you, to link Aadhaar with PAN.

Even individuals who are not required to file I-T returns due to income being below exemption limit but possess both PAN and Aadhaar are mandatorily required to link both by a date to be notified as per section 139AA. If

a person does not link PAN and Aadhaar as mandated by section 139AA then his / her PAN would become invalid.

The objective is, to curb fraudulent practices.

- If you do not have Aadhaar card, apply for one today! After the Supreme Court upheld Aaadhar-PAN linkage, the Government has issued clarification highlighting the following:

- From July 1, 2017 onwards, every person eligible to obtain Aadhaar must quote their Aadhaar number or their Aadhaar Enrolment ID number to file I-Tax returns as well as for PAN application.

- Everyone who has been allotted a PAN as on the July 1, 2017, and those who have Aadhaar number or are eligible to obtain an Aadhaar number shall intimate his/her Aadhaar number to income-tax authorities for the purpose of linking

PAN with Aadhaar.

- However, in case of non-compliance to the above point, the Court has given only partial relief to those who do not have Aadhaar and who do not wish to obtain an Aadhaar for the time being, their PAN will not be cancelled; so other

consequences under the Income-Tax Act for failing to quote PAN may not arise.

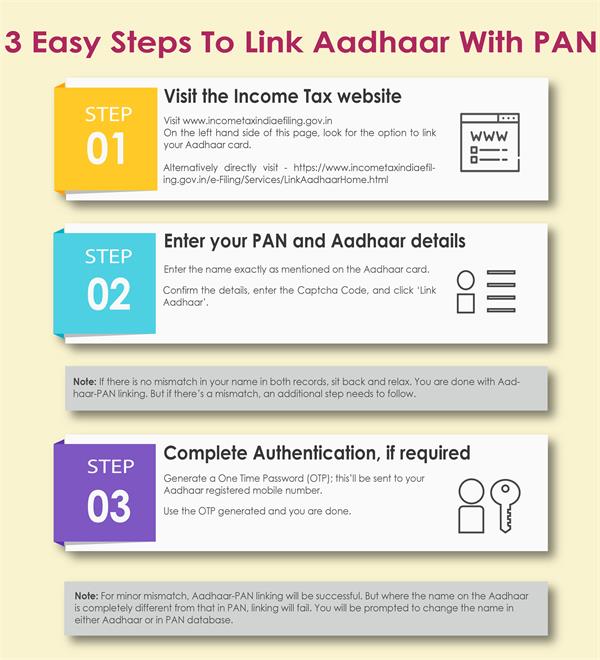

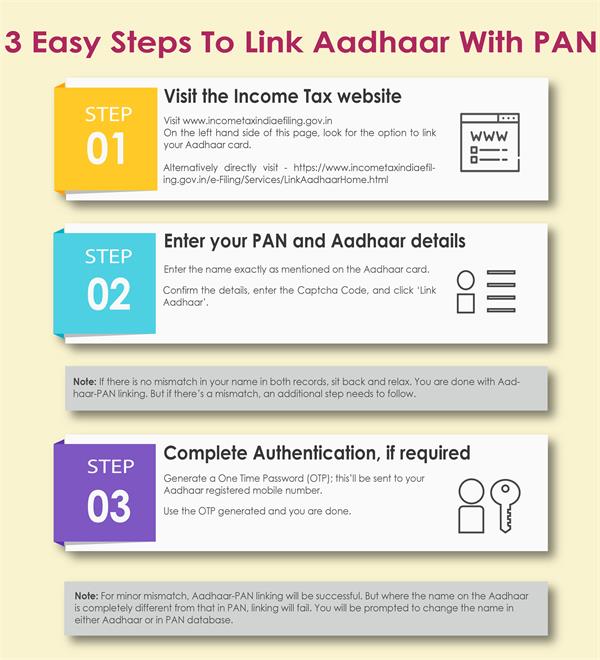

Please note that to link your PAN with Aaadhar, you need to visit the Income Tax departments e-Filing website. On visiting the homepage of the Income-Tax India e-Filing portal, the option to link your Aadhaar card can be seen on the left-hand

side. Enter your PAN and Aadhar detail as prompted and you will be done in few easy steps.

The facility for Aadhaar-PAN linking is also available after logging in to your Income-Tax e-Filing account. Go to Profile settings and choose

Aadhaar linking. The details as per PAN are pre-populated. Enter the Aadhaar number and the name EXACTLY as given in Aadhaar card (avoid spelling mistakes) and submit. The process here is the same as the one explained above.

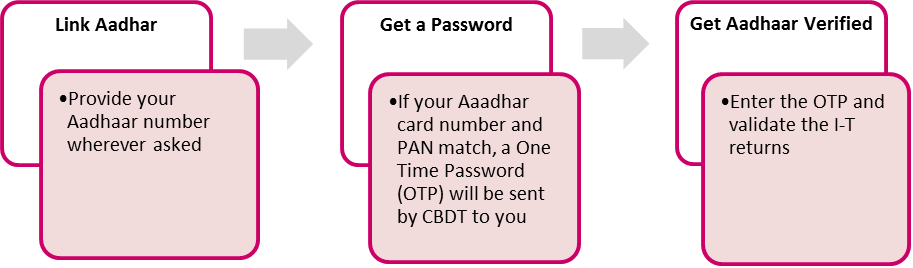

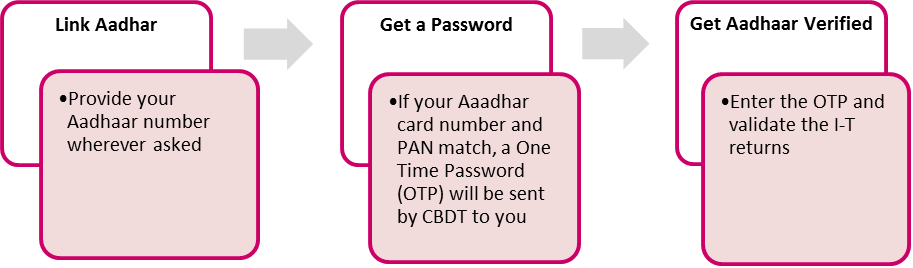

You see,

the Central Board of Direct Taxes (CBDT) vide the new Income-Tax Return (ITR) forms has introduced a new verification system under which Aadhaar linked Electronic Verification Code (EVC) will be used to verify returns filed online using an

OTP. This is how it will work..

So if you have an Aadhar

card, filing return online would be hassle-free and even obtaining refunds may not be delayed. This would do away with the risk (where forms do not reach on time or even get lost in transit) while sending verification forms physically to the

CPC in Bengaluru within 120 days of e-filing tax returns.

To conclude…

Engage in prudent tax planning exercise right from the beginning of the financial year and do not forget to file your income tax return on time. There’s no point waiting till the eleventh hour. Tax

planning is more than investing in tax saving instruments under Section 80C. It’s far more holistic. Even your CA or tax advisor, can hardly do much if you reach out close to the due date.

Remember, what Sir Winston Churchill said, “All men make mistakes, but only wise men learn from their mistakes."

So, avoid keeping tax filing and tax planning at the eleventh hour and be in complete control of your personal finances always! Timely and conscious tax planning can not only help you save tax but ensure your long-term financial wellbeing.

Even if you do not have an Aadhar card for the time being, go ahead and file your I-T return on time and make sure you make all necessary disclosures. Not disclosing all income or assets tantamount to creation of black money which should

be always avoided. Be on the right side of the law and judiciously honour the constitutional and moral responsibility.

Disclaimer: This article has been authored by PersonalFN, a Mumbai based Financial Planning and Mutual Fund research firm known for offering unbiased and honest opinion on investing. Axis bank doesn't influence any views of the author in any way. Axis Bank & PersonalFN shall not be responsible for any direct / indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information. Please consult your financial advisor before making any financial decision.