6 MinsJan 5, 2022

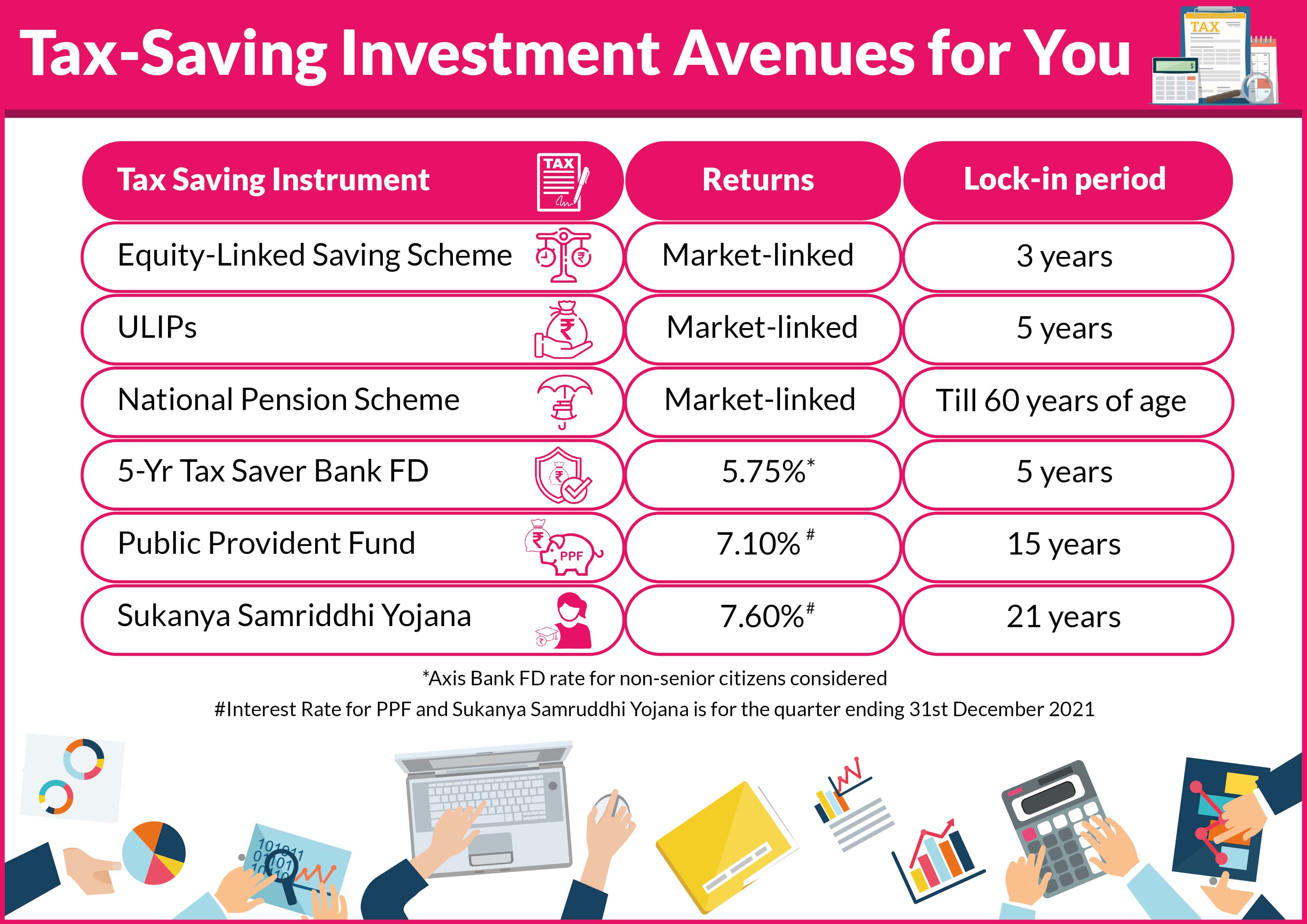

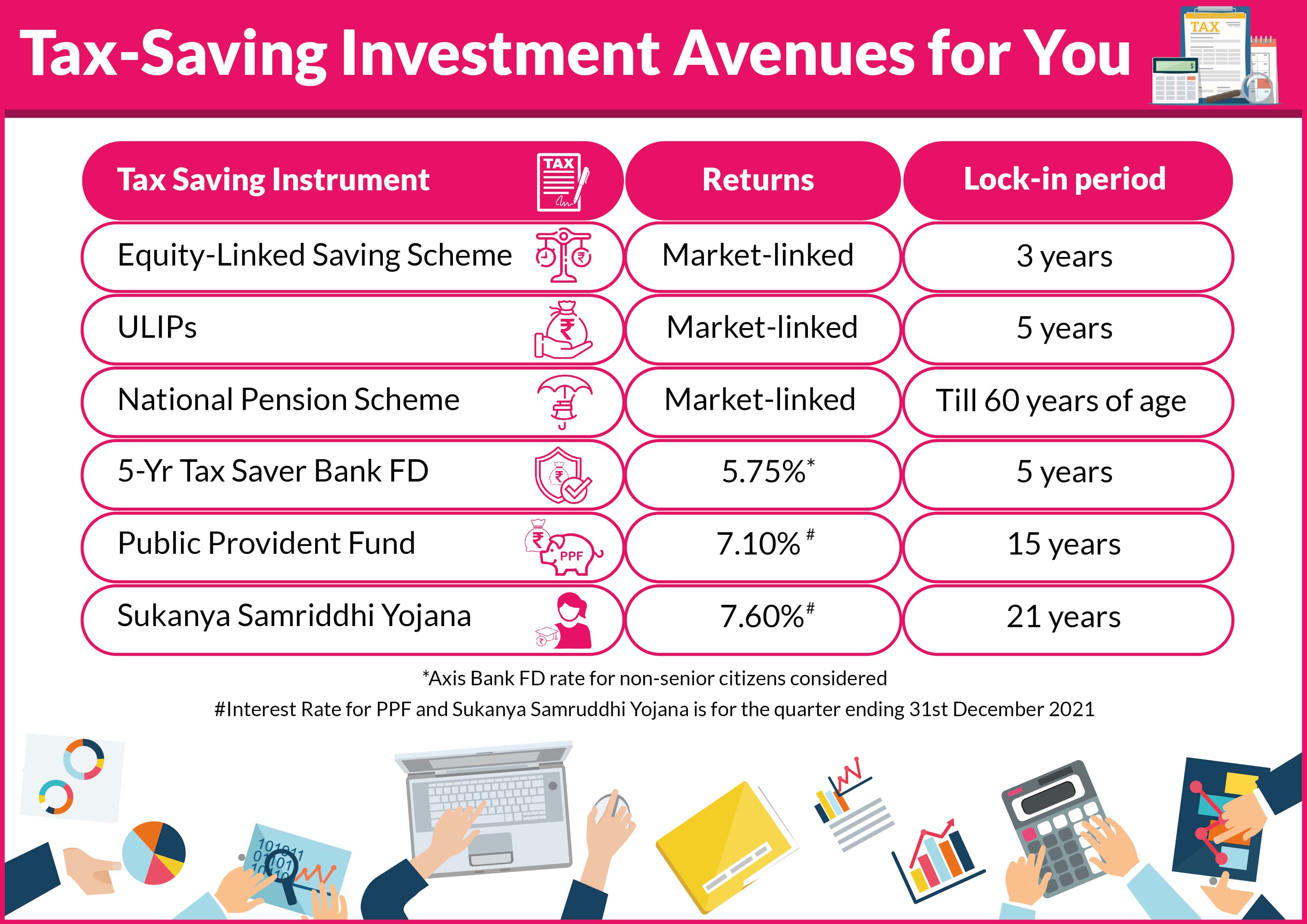

Have you made your tax-saving investments for this financial year? If not, then do so without any further delay. Pick the tax-saving investment to match your risk profile, investment objectives, and investment time horizon.

You may be young investor with a high-risk appetite in the wealth accumulation phase of your life, or you may be a conservative investor with liabilities or close to retirement.

Here are some of the investment options that offer tax exemption up to Rs 1.5 lakh under Section 80C. What’s better, you can invest in all these instruments online through your Axis Bank internet bank account, thereby saving yourself time.

While you cannot open the Sukanya Samriddhi account, you can make the subsequent contributions through internet banking.

Lets’ see the features of these investments in detail:

Equity Linked Savings Scheme (ELSS)

- A diversified equity mutual fund which is usually is market-cap and sector agnostic

- It may follow a growth, value style, or even a blend of both

- Lock-in period is 3 years; lowest among all tax-saving instruments

National Pension System

- A government of India scheme which offers tax and retirement planning

- Tier-I NPS Account offers tax exemption benefits under Section 80 C and 80 CCD (1B), additionally you can get tax benefit under Section CCD (2) if your employer contributes to the account. Tier-II NPS Account does not offer any tax benefit

- Minimum contribution to open the account is Rs 500 and minimum contribution required every year is Rs 1000

- Lock-in period is till 60 years of age, but premature withdrawal option is available

- Under the Active Choice option, money is invested in multiple assets. Maximum equity allocation will be 75% until you turn 50 years of age, and thereafter it will gradually reduce

- Auto Choice is the default option and life cycle fund, wherein money is invested dynamically as per your age into equity, corporate bonds, and government securities with three life cycle fund choices––aggressive, moderate, and

conservative––suitable to your risk profile

[Also Read:Tax Saving Tips & Schemes]

Life Insurance plans

- Insurance-cum-investment plans that offer returns (either fixed or market-linked) with life insurance coverage such as Unit Linked Insurance plans (ULIPs) and traditional plans such as wealth plans and monthly income plans

- Investment in ULIPs is subject to a lock-in period of five years

- Under ULIPs you have the option to invest in a variety of funds—an equity-oriented, debt-oriented, mix of both (hybrid), etc. and you are allotted units against the NAV of the respective fund (just as in the case of mutual funds)

- The returns are tax free if annual premiums are lesser than Rs 2.5 lakh

- Traditional savings plans have no lock-in period, but it is advisable to hold till maturity in order to maximise your returns

- These plans invest in fixed income instruments such as government securities and bonds and hence offer fixed returns, which are tax-free

Public Provident Fund (PPF)

- Government-backed small savings scheme that offers fixed and guaranteed returns

- One of the few investment options with Exempt-Exempt-Exempt (E-E-E) tax status i.e. the contributions, the interest earned and maturity proceeds are exempt from tax

- The interest is compounded annually. The current interest rate is currently at 7.1% and it is reviewed quarterly

- Minimum investment is Rs 500 per year, and is mandatory to keep the account active

- Lock-in period is 15 years with option to extend in blocks of 5 years. There is an option to partially withdraw the corpus before maturity, for certain specified purposes

- Investments can be made in monthly or quarterly instalments, or annually in a lump sum

You can also link your PPF with a savings account for more benefits

5-Year Tax Saver Bank Fixed Deposit

- Offers fixed and secured returns

- Lock-in period of 5 years, i.e. you cannot prematurely encash/liquidate/withdraw your investments within this period

- Three options: Tax Saving - Reinvestment Deposit; Tax Saving - Quarterly Interest Payout; or Tax Saving - Monthly Interest Payout

- Eligible Customers: Individual and HUF

Sukanya Samriddhi Yojana (SSY)

- If you have a girl child, you can invest in Sukanya Samriddhi Yojana account with Axis Bank

- Like PPF, the SSY is also a government-backed savings scheme that has Exempt-Exempt-Exempt (E-E-E) tax status i.e. the contributions, the interest earned and maturity proceeds are exempt from tax.

- Open the SSY Account any time before your daughter turns 10 years

- Initial amount required to open the SSY Account is Rs 250, and thereafter regular deposits are required to be made at least once every year till the completion of 15 years from the date of account opening

- Tenure of the SSY Account is 21 years

- The mandatory minimum yearly contribution required is Rs 250 (and in multiples of Rs 50). If the minimum annual contributions are not made, the SSY Account will become inactive

- Currently, the interest rate on SSY deposits is 7.6% p.a. (compounded annually)

Disclaimer: This article has been authored by PersonalFN, a Mumbai based Financial Planning and Mutual Fund research firm. Axis Bank doesn't influence any views of the author in any way. Axis Bank & PersonalFN shall not be responsible for any direct / indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information. Please consult your financial advisor before making any financial decision.