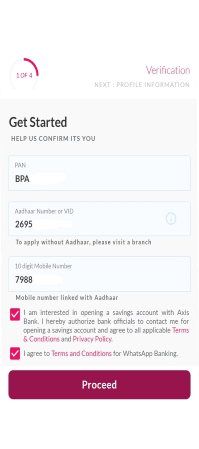

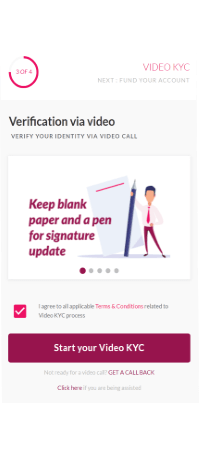

1) I hereby state that I have no objection in authenticating myself with video based customer identification process (“V-CIP”). Further, I expressly consent to and authorise the

Bank (whether acting by itself or through any of its service providers, and whether in automated manner or otherwise), to do and undertake any of the following, in relation to my application details including

my photograph, personal data and sensitive information about me, information, papers and data relating to know your customer (KYC), credit information, and any other information whether about me or not as

may be deemed relevant by the Bank (collectively, “Information”) for the purposes of (“Purposes”) via V-CIP:

a. to use devices and/or software, including the app, to record and capture my Information, interactions inclusive of video and which will be used for the Information verification and Purposes;

b. to collect the Information from me and other physical or online sources including accessing the same from credit information companies, information utilities, websites, data bases and online platforms (whether

public or not); to get the authenticity, correctness, adequacy, etc. of the Information verified from any sources and persons including from online data bases; and to act for and on my behalf for such accessing,

collecting or verifying of the Information including using my log in and password credentials on the online platforms; such collection, access and verification may be done without any notice to me;

c. process Information including by way of storing, structuring, organising, reproducing, copying, using, profiling, etc. as may be deemed fit by the Bank;

d. to store the Information for such period as may be required for contract, by law or for the Bank’s evidential and claims purposes, whichever is longer;

e. to share and disclose the Information to service providers, consultants, credit information companies, information utilities, other banks and financial institutions, affiliates, subsidiaries, regulators,

investigating agencies, judicial, quasi-judicial and statutory authorities, or to other persons as may be necessary in connection with the contractual or legal requirements or in the legitimate interests

of the Bank or as per the consent;

f. any of the aforesaid may be exercised by the Bank for the purposes mentioned above, for the purposes of credit appraisal, fraud detection, anti-money laundering obligations, for entering into contract, for

direct marketing, for developing credit scoring models and business strategies, for monitoring, for evaluating and improving the quality of services and products, for other legitimate purposes or for any

purposes with consent.

I hereby state that I have no objection in authenticating myself with Aadhaar based authentication system and consent to providing my Aadhaar Number, Biometric and/or (One Time Pin) OTP data (and/or any similar

authentication mechanism) for Aadhaar Based authentication for the purposes of availing of the Banking Service from Axis Bank.

I understand that the Biometric and/or (One Time Pin) OTP (and/or any similar authentication mechanism) I may provide for authentication shall be used only for authenticating my identity through Aadhaar Authentication

system for that specific transaction and for no other purposes. I understand that Axis Bank shall ensure security and confidentiality of my personal identity data provided for the purpose Aadhaar based authentication.

I submit my Aadhaar number and voluntarily give my consent to:

2) I expressly agree to and subject me to the automated processing, automated profiling and to the automated decision making by or on behalf of the Bank.

3) I expressly agree to the Bank and/or its affiliates for using the Information and for cross-selling to me their various products and services from time to time.

4) I hereby confirm that I have read and I hereby accept the Privacy Policy of Axis Bank Limited (“Bank”) available at.