What is a Home Loan EMI Calculator?

A House Loan EMI calculator is a free online tool that calculates the Equated Monthly Installment (EMI) that you need to pay to repay your loan amount. You can find out your monthly EMI in seconds by merely entering the loan amount, interest rate and loan tenure in their designated boxes.

Key components

- Loan Amount: The total sum borrowed from the bank.

- Interest Rate: The rate of interest charged on the loan amount.

- Loan Tenure: The duration for which the loan is being taken.

Apart from basic calculations, the Axis Bank advanced Housing Loan calculator provides a deeper understanding of your loan and structure. The calculator also provides you with an annual amortisation schedule that allows you to plan your loan repayment scenario better. Your amortisation schedule helps you understand how your interest decreases as your principal decreases.

The housing loan calculator also allows you to experiment with different loan scenarios before deciding on one. By adjusting and readjusting the variables multiple times, you can find the best-suited borrowing structure that aligns with your financial goals and helps you make an informed decision.

Axis Bank Home Loan EMI Calculator

Dreaming of your own space? Whether it's a sprawling apartment or a snug bungalow, the journey to your dream home is now simpler. Our Home Loan EMI calculator is your go-to partner for crafting a financial plan that turns dreams into

addresses.

This user-friendly Home Loan calculator is designed to give you control over your finances. With just a few clicks, you can set the loan amount and duration that sync with your budget and lifestyle. Adjust the inputs in our Home Loan EMI Calculator to see customized options that help you make well-informed financial decisions. The calculator accurately accounts for current interest rates, guiding you to strategies that minimize the interest paid over the life of your Home Loan.

Take advantage of our calculator to balance your finances and pave a smooth path to the home you've always wanted. It's more than a calculator—it's your financial compass for the exciting journey ahead.

Here’s why you should use a Home Loan EMI calculator

Begin your home-buying journey with a clear financial plan by using our Home Loan EMI calculator online. It's a pivotal tool for:

- Smart budgeting: Quickly discover an EMI that's manageable for you, considering your loan amount, interest rate, and preferred tenure.

- Transparent repayments: Receive a detailed breakdown of your repayments, showing how much goes towards the loan principal versus the interest.

- Interest tracking: Easily calculate your monthly and annual interest payments to anticipate your financial outflow over the loan period.

- Future forecasting: Gain insight into potential interest savings with different EMI options or loan tenure adjustments.

At Axis Bank, we accompany you as you navigate through the significant milestone of home ownership. Our Home Loan EMI calculator is a cornerstone among the bespoke tools we offer, crafted to optimise your Home Loan experience and maximise

your savings on interest payments.

Advantage of using a Home Loan EMI Calculator

The Axis Bank Home Loan Calculator offers multiple advantages when you are in the process of getting your dream home

- Financial clarity and planning: With the Home Loan calculator, you can see immediate results regarding how much EMI you will have to pay monthly. Such clarity helps you to manage your finances in a precise manner, minimising the chances of overextension.

- Time efficiency: A home EMI calculator is a fast and efficient way of calculating your EMI. It eliminates the need for long manual calculations, thereby preventing the chance of calculation errors and saves time.

- Interest insights: The calculators reveal the total interest outflow for your principal amount over the loan tenure. This insight compels you to consider strategies such as paying a higher down payment or opting for shorter loan tenures.

- Stress testing: The Home Loan calculator helps you evaluate how your loan might be affected by potential future changes, such as fluctuations in interest rates. This is particularly true for loans taken at floating rates of interest. Gathering this foresight can help you keep funds ready for times when the market is extremely volatile.

How to use the Home Loan EMI Calculator

Using the Axis Bank's House Loan EMI calculator is straightforward and requires just a few simple steps. Here’s how you can do it:

- Enter the loan amount: Once you have found the Home Loan calculator, enter the principal amount you want to borrow.

- Specify interest rate: Provide the applicable interest rate for the loan. Make sure to include the correct annual interest rate to get a near-accurate estimate.

- Select loan tenure: Choose the duration for which you want to borrow the loan amount. Axis Bank offers a maximum repayment tenure of up to 30 years.

- Calculate EMI: Once you have entered these details, the calculator will automatically calculate your EMI amount and display the monthly payment you will have to make.

- Review amortisation schedule: Check the annual amortisation schedule to see the principal and interest that would be repaid every year throughout the loan tenure.

Start the journey to your dream home today with our Home Loan EMI Calculator. It helps you to explore more options, get a clear picture of the interest rates for ₹30 lakh and ₹50 lakh Home Loans, and plan your financial path with confidence.

Axis Bank is committed to offering personalised guidance at every step of your Home Loan journey.

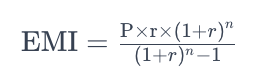

Formula to determine Home Loan EMI amount

The EMI amount for a Home Loan calculator is calculated using a standard financial formula. Your EMI amount is calculated using your principal amount, interest rate and loan tenure.

Where:

- P is the principal loan amount

- r is the monthly interest rate (annual rate divided by 12)

- n is the number of monthly instalments or the loan tenure in months

Example: For a ₹20 lakh loan at a 7.5% annual interest rate over 10 years, the EMI would be calculated as:

EMI: 20,00,000 x 0.00625 x (1 + 0.00625)^120 divided by [(1 + 0.00625)^120 - 1]

So, the EMI per month will be ₹23,740 for 10 years or 120 months.

This formula considers compound interest, giving you a precise monthly payment amount. You can calculate the EMI beforehand using this formula or our online Home Loan calculator. It helps you understand how different variables can

affect your monthly payments, empowering you to make well-informed financial decisions on the loan amount and tenure that best suit your financial situation.

Home Loan EMI calculator: Features & benefits

Axis Bank's Home Loan EMI Calculator is an indispensable online tool for prospective homeowners. This calculator simplifies complex calculations, offering a quick peek into your future financial commitments when considering a Home

Loan.

Features:

- User-friendly interface: Our Home Loan EMI Calculator is designed for ease, delivering results with just a few clicks.

- Instant calculations: Input your loan amount, interest rate, and tenure to instantly receive your EMI.

- Customisable options: Experiment with different loan variables to find a comfortable EMI for your budget.

- Amortisation schedule: Gain insights into the principal and interest components of each EMI.

Benefits:

- Financial planning: Plan your home purchase with a clear understanding of your EMI commitments.

- Budget management: Modify the loan terms to suit your financial capability for repayments.

- Interest rate comparisons: Use the Home Loan calculator to compare different loan offers.

- Accessible anywhere: The Home Loan EMI calculator online is available 24/7, making it a convenient option for busy individuals.

Explore 250+ banking services on Axis Mobile App