5 MinsJuly 23, 2021

Has your credit card application been rejected? It could be due to a lack of regular income or too many credit card applications, etc. If yes, don’t lose hope. You can still get a credit card in your name, provided you have a tidy sum in

savings. This kind of credit card is backed by a Fixed Deposit.

Now you may ask, why you would need a credit card if you already have a hefty amount in a Fixed Deposit. Remember, a credit card is not just a convenient tool for spending but also helps in building good credit behaviour, if used judiciously.

Let us see how an FD-backed credit card works.

What is an FD-backed credit card?

Simply put, an FD-backed credit card, or a secured credit card, is a type of credit card issued against a fixed deposit. The FD amount is held as collateral by the bank. Since the minimum FD amount starts from as low as Rs 10,000 – Rs 20,000

(for Axis Bank, this is Rs. 20,000), it is pretty affordable. The FD amount will directly determine your credit card limit.

Most banks usually provide 75% to 85% of the FD amount as the limit for a credit card. For Axis Bank, this is 80% of FD amount. The higher the FD amount, the higher the credit card limit. Generally, banks require an FD tenure of at least six months

for issuing a card. For Axis Bank, this is 1 year. If you do not pay the outstanding, the bank has the right to recover the dues from the FD, after informing you.

Since the credit card is linked to the FD, if you ever need to redeem the FD for any emergency, you will need to first cancel the card, post which you can access funds from the FD. Keep this in mind when opting for an FD-backed credit card.

How to apply for an FD-backed credit card?

Customers will have to open a fixed deposit with their bank and then apply for a credit card. You can apply by visiting the bank branch.

What are the features of credit cards against fixed deposits?

- Affordable amount: The minimum fixed deposit amount usually ranges anywhere between Rs. 10,000 and Rs. 20,000. For Axis Bank, this is Rs.20,000.

- Decent credit limit: Usually, a bank offers 75% to 85% of the deposit amount as the credit limit on your card. The higher the FD amount, the higher will be your credit limit. For Axis Bank, this is 80% of FD value.

- Minimal documentation: To apply for a secured credit card, you won’t have to submit many documents since your spending on the card is tied to the FD. It is easily approved as compared to a regular credit card

- Interest-free period: Usually, banks offer an interest-free period anywhere between 48 to 55 days on secured credit cards. For Axis Bank, this is up to 50 days.

- Rewards and points: Secured credit cards offer similar rewards like regular credit cards like cash-back offers, reward points, etc.

- Interest on fixed deposits: Cardholders continue to earn interest on their fixed deposits.

[Also Read: Five Advantages of a Fixed Deposit]

What are the benefits of having a credit card against fd?

- Income proof not required: Customers can get a credit card without providing any income proof. Apart from professionals, this is useful for homemakers, students, gig-economy workers, among others. Some banks offer this

facility to customers from the age of 18, while others have a minimum age of 21.

- Helps build credit history: Using your credit card regularly and paying off the outstanding dues on time, will help create a good credit history and credit score. Once you build your credit score, it will be easier when

you apply for other loans such as Personal Loans, auto loans or home loans.

If your bank sees you as a prudent borrower, your loan may get approved faster and you may even get a higher loan amount.

- Allows a higher credit limit: If you have a big-ticket FD, you can even get a higher credit limit on your card, which may not be possible with just your income statement. For instance, in the case of Axis Bank, the maximum

FD amount allowed for a secured credit card is Rs 25 lakh. This means you could get a credit card with a credit limit of Rs 20 lakh, which is quite high.

A secured credit card helps build discipline and encourages good credit behaviour. Once you have used a secured credit card for some time, you can apply for an unsecured credit card with higher spending limits.

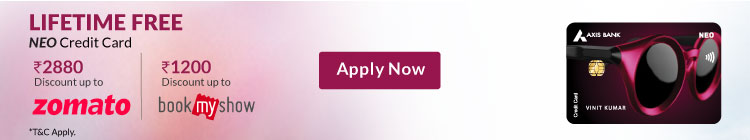

Axis Bank offers a range of credit cards with various benefits tailored to its customers' preferences. The minimum FD value for this product is Rs 20, 000 (so the minimum credit limit is Rs 16,000).

Features of Axis Bank secured credit cards variants like Flipkart, Indian Oil and Privilege are the same as the unsecured versions. Depending on your spending patterns, you are also entitled to Edge Reward points,

which you can redeem for a range of attractive deals and offers.

To know more about Axis Bank Credit Cards, visit us online.

Disclaimer: The Source, content creation and curation firm have authored this article. Axis Bank does not influence the views of the author in any way. Axis Bank and The Source shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information. Please consult your financial advisor before making any financial decision.