3L

5Cr

6.5%

11%

1

30

Banking is now at your fingertips with Axis Mobile! Give a missed call to 8422992272 to receive the download link for Axis Mobile via SMS

Effortlessly plan your financial journey with Axis Bank's Home Loan EMI Calculator. Perfect for calculating your monthly payments and interest rates, whether you're considering a ₹30 lakh home loan for 20 years or a ₹20 lakh loan over 10 years, this tool offers immediate clarity on your financial commitments. Equip yourself with the knowledge to manage your Home Loan commitments smartly and efficiently.

Axis Bank does not guarantee accuracy, completeness or correct sequence of any the details provided therein and therefore no reliance should be placed by the user for any purpose whatsoever on the information contained / data generated herein or on its completeness / accuracy. The use of any information set out is entirely at the User's own risk. User should exercise due care and caution (including if necessary, obtaining of advise of tax/ legal/ accounting/ financial/ other professionals) prior to taking of any decision, acting or omitting to act, on the basis of the information contained / data generated herein. Axis Bank does not undertake any liability or responsibility to update any data. No claim (whether in contract, tort (including negligence) or otherwise) shall arise out of or in connection with the services against Axis Bank. Neither Axis Bank nor any of its agents or licensors or group companies shall be liable to user/ any third party, for any direct, indirect, incidental, special or consequential loss or damages (including, without limitation for loss of profit, business opportunity or loss of goodwill) whatsoever, whether in contract, tort, misrepresentation or otherwise arising from the use of these tools/ information contained / data generated herein.

Home Loan EMI, or Equated Monthly Instalment, is a systematic approach to repaying your Home Loan in uniform amounts per month, combining the principal and interest. The amount borrowed and interest payable are divided throughout the term of the loan in manageable monthly instalments, making it easier on your budget.

Dreaming of your own space? Whether it's a sprawling apartment or a snug bungalow, the journey to your dream home is now simpler. Our Home Loan EMI calculator is your go-to partner for crafting a financial plan that turns dreams into addresses.

This user-friendly Home Loan calculator is designed to give you control over your finances. With just a few clicks, you can set the loan amount and duration that sync with your budget and lifestyle. Adjust the inputs in our Home Loan EMI Calculator to see customized options that help you make well-informed financial decisions. The calculator accurately accounts for current interest rates, guiding you to strategies that minimize the interest paid over the life of your Home Loan.

Take advantage of our calculator to balance your finances and pave a smooth path to the home you've always wanted. It's more than a calculator—it's your financial compass for the exciting journey ahead.

Begin your home-buying journey with a clear financial plan by using our Home Loan EMI calculator online. It's a pivotal tool for:

At Axis Bank, we accompany you as you navigate through the significant milestone of home ownership. Our Home Loan EMI calculator is a cornerstone among the bespoke tools we offer, crafted to optimise your Home Loan experience and maximise your savings on interest payments.

Start the journey to your dream home today with our Home Loan EMI Calculator. It helps you to explore more options, get a clear picture of the interest rates for ₹30 lakh and ₹50 lakh Home Loans, and plan your financial path with confidence. Axis Bank is committed to offering personalised guidance at every step of your Home Loan journey.

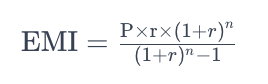

The formula to determine your EMI amount is a straightforward mathematical equation, ensuring transparency and accuracy in your financial planning. Here's the formula that powers our Home Loan EMI calculator:

Where:

Example: For a ₹20 lakh loan at a 7.5% annual interest rate over 10 years, the EMI would be calculated as:

EMI: 20,00,000 x 0.00625 x (1 + 0.00625)^120 divided by [(1 + 0.00625)^120 - 1]

So, the EMI per month will be ₹23,740 for 10 years or 120 months.

This formula considers compound interest, giving you a precise monthly payment amount. You can calculate the EMI beforehand using this formula or our online Home Loan calculator. It helps you understand how different variables can affect your monthly payments, empowering you to make well-informed financial decisions on the loan amount and tenure that best suit your financial situation.

Axis Bank's Home Loan EMI Calculator is an indispensable online tool for prospective homeowners. This calculator simplifies complex calculations, offering a quick peek into your future financial commitments when considering a Home Loan.

Features:

Benefits:

The minimum amount you can borrow from Axis Bank for a Home Loan is ₹3 lakh, providing a flexible starting point for your property financing needs.

Your Home Loan EMI will be due on a specific date each month, and you will be notified once the loan amount is disbursed to you.

You can utilise a Home Loan for various housing-related expenses, including construction, repairs, renovations, and adding extensions to your existing home.

A Home Loan comes with tax-saving benefits. You can get a deduction of up to ₹1.50 lakh on the principal (Section 80C of the Income Tax Act) and up to ₹2 lakh on interest for self-occupied homes (Section 24(b)). First-time buyers get an extra ₹50,000 deduction (Section 80EE). For rented-out properties, there's no cap on interest deduction. However, for reconstruction or repair, the interest deduction is limited to ₹30,000.

Home Loan EMIs at Axis Bank typically start after the full disbursement of the loan amount. However, the exact start date of your EMI can vary based on the terms of your loan and will be communicated to you at the time of loan disbursement.

Pre-EMI interest on a Home Loan is the interest applied to the loan portion disbursed before the full loan amount is released. This situation typically occurs during the construction phase of a property purchase when the loan is disbursed in instalments based on construction progress. During this period, you're required to pay only the interest on the amount disbursed, not the principal.

Changing your Home Loan EMI date at Axis Bank usually involves reaching out to the bank with a formal request. This can also be done through Axis Bank's online customer portal, where you can navigate to the loan section and look for the option to modify your EMI date. Alternatively, you could visit your nearest Axis Bank branch and speak directly with a loan officer who can assist with the change.

If you are looking at saving on the interest cost while you aspire to purchase, construct, ...