4 minsAugust 11, 2017

Buying a car and going on long drives is the dream of most families. And today, fulfilling this financial and emotional goal has become increasingly easy with car loans available at competitive rates (credit to RBI for turning accommodative and

reducing policy rates), and with automobile manufacturers having reduced prices across types and variants (a positive impact of the Goods & Services Tax regime).

Currently, the interest rates on car loan from banks range from 8.75% to 13.5%, and if your credit score is high, you could even bargain for the best rate.

Axis Bank is offering car loans starting at 11% and provides loans upto 95% of the ex-showroom price on select

models (Loan-To-Value (LTV)). Plus, if you are priority banking or a wealth banking customer of Axis Bank, there’s a special scheme for you with lower processing fees, waiver of income documents and bank statements. You also have a chance

to earn Axis eEDGE Reward points and these be redeemed

against some exciting offers.

- Who is eligible for a car loan?

- A salaried individual, self-employed whether in business or profession are eligible to apply. One can even apply on the name of the HUF, firm, company, etc. to avail of the depreciation (a deductible expense) benefit, under the Income-tax

Act.

- Individuals between 18 to 75 years, irrespective whether salaried or self-employed, are eligible, subject to certain conditions.

- Salaried individuals preferably should have a total work experience of at least 3 years, while for a self-employed, a minimum of 2 years in the current business or profession. In case of the latter, the stability counts in the due

diligence process, while for salaried individuals, the type of employment, who is the employer, carries weight.

- Moreover, where you reside i.e. country, urban/semi-urban/rural area, and the number of years you’ve been residing there, type of residence, whether on rent, family-owned, or self-owned, matters.

- The bank or the lending institution would look at your monthly income —and the better it is, higher is the amount of car loan that you will be

eligible for, and greater is the chance of it being disbursed soon. Broadly, the monthly income requirement is a minimum of Rs 10,000, subject to the type of vehicle you seek to buy and depending on the lender’s requirement.

Axis Bank requires salaried individuals to be earning a minimum net annual salary of Rs 2.40 lakh per annum (p.a.); whereas in case of self-employed individuals, their net annual business income should be Rs 1,80,000 p.a. for selected

models and Rs 2,00,000 p.a. for other models.

The lending institution or bank would closely scrutinise the following documents before deciding on the loan amount to be disbursed:

- Income statements

- Bank statements

- Salary slips and Form 16

- Latest Income-Tax Returns

- Credit report

- Age proof

- Address proof

- Photo identification proof

Besides, the type of vehicle you wish to buy, the loan tenure (3 years, 5 years, or 7 years), employment stability, and pre-existing EMIs (or Equated Monthly Instalments) on outstanding loans will be looked at closely before approving a loan at

a certain EMI.

Your credit worthiness is determined with in the entire due diligence process. And as mentioned before, if you have a high credit score (of 750 and above), you can get a better bargain, a good deal; where you would enjoy a lower interest rate

and the processing fee will be the least possible or even waived-off.

This is where you enter the relevant data in the required fields to know your car loan eligibility. And to know how much the EMI would be on the car,

the Car Loan EMI Calculator can be the resource.

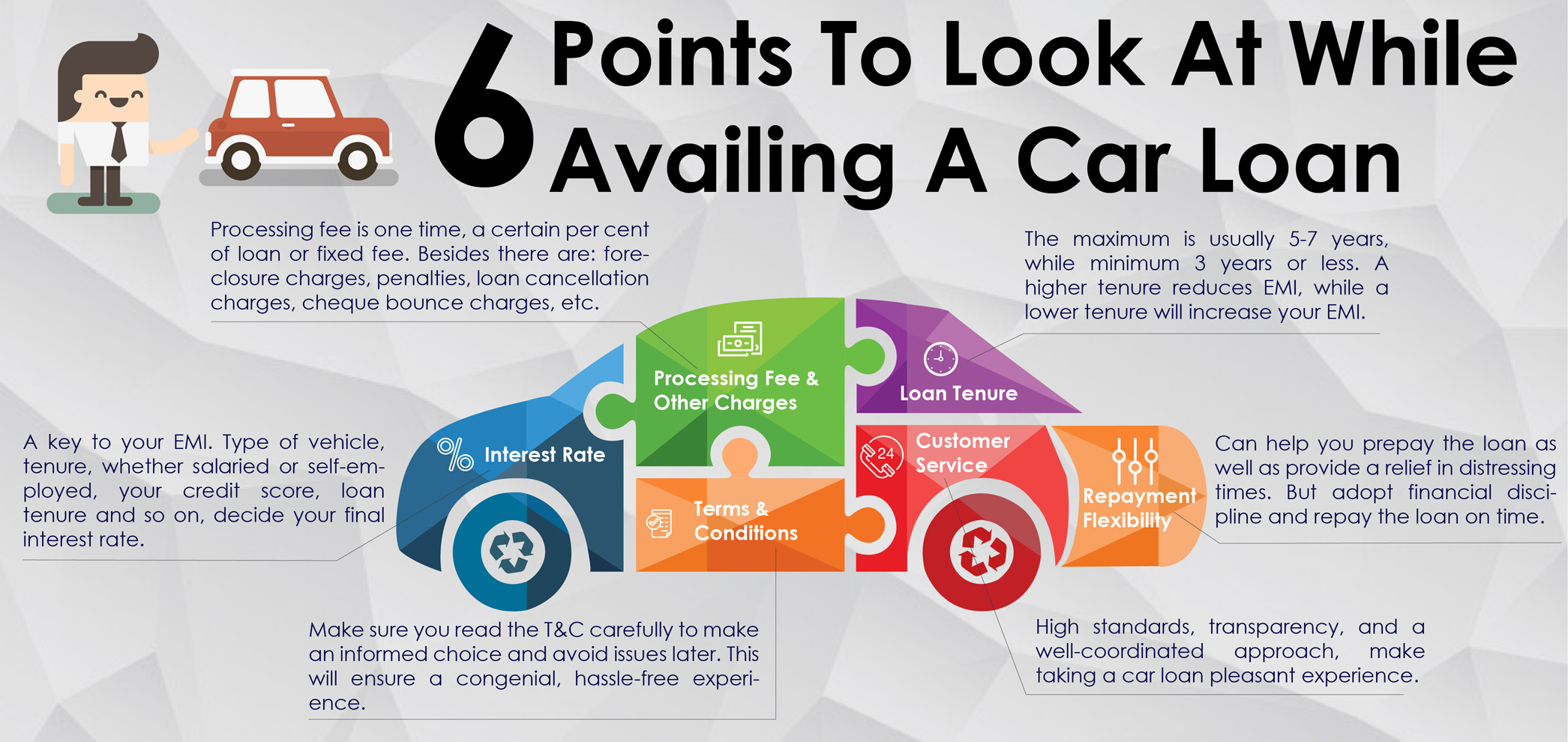

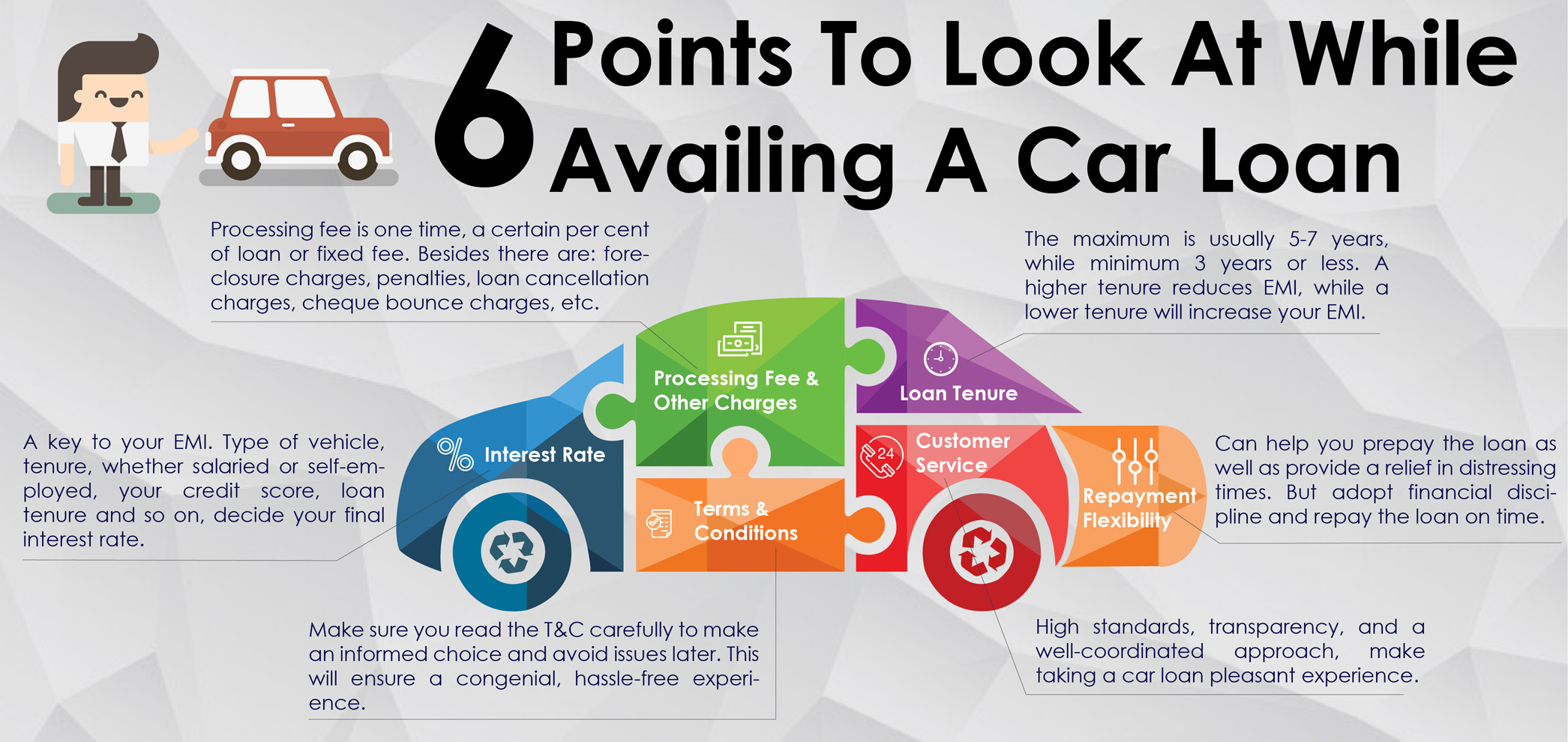

What are the factors to look at?

- Interest rate

- When you take a loan, the interest outgo is one of the vital deciding factors.

- The interest rate you would pay depends on a variety of factors: type of vehicle you wish to buy on loan, your credit worthiness, risk profile, tenure of the loan, whether you’re a salaried individual, self-employed, priority

banking customer, among other things.

- The interest outgo would determine your EMI and has a bearing on your budgets and long-term financial wellbeing.

- Processing fee & other charges

- Buying a car loan does not stop with just interest rates; there are processing and other charges levied by lenders. The processing fee is the one-time fee charged

as a certain per cent of the loan, but capped at an ‘x’ amount. Some lenders levy a fixed processing fee. Axis bank levies Rs 3,500 to Rs 5,500 as processing fee, inclusive of GST. A higher processing fee impacts your

total cash outflow while availing a loan.

- As regards the other charges, they include: prepayment charges (also known as foreclosure charges), part-payment charges, late payment penal interest, loan cancellation charges / re-booking charges, cheque bounce charges and so on,

all of which you should examine carefully.

- Loan Tenure

- The maximum tenure for a loan car is usually between 5 to 7 years. A higher tenure can reduce your EMIs, making repayments comfortable, while opting for a lower tenure (of say 3 year or 5 years) increases your EMI.

- Repayment flexibility

- Apart from the above pivotal aspects, assess if the lender provides you with the flexibility to repay your loan sooner, and at what cost does this come at. This flexibility can help you prepay the loan ahead of time, as well as provide

a relief in distressing times.

- However, it’s best to adopt financial discipline in order to repay loans on time and maintain your financial health in the pink always.

- Customer service

- You want to buy your dream car with a smile on your face, don’t you? So, ensure that the customer service at the lender has high standards.

- This service can even help keep track of your loan, allow you to be in better control of your personal finances. Remember, while lenders will have varying customer service standards, there are some basics of good service that are universal.

Terms & conditionsMake sure you read the terms & condition carefully to make an informed choice. This will avoid issues later and ensure a pleasant, hassle-free experience.

- Availing of a car loan carries the following benefits

- Your existing finances are not exhausted and the loan can be worked out to suit your budget, facilitating you to save

- You don’t have to touch your existing investments assigned for other important financial goals such as children’s future (their education and marriage needs) and your own retirement

- You don’t have to mortgage your existing assets; because a car loan is a secured loan (secured against the car itself). Meaning, until the loan is repaid in full, the lending institution/bank has right of lien on the asset, which

confers upon it the power to seize the asset and recovering the dues by selling the vehicle.

- You have the opportunity to own the car and spend happy moments with your family while you service the loan

Remember, paying upfront in cash could put you under the Income-tax department’s radar, more so after demonetisation. But, paying an upfront amount to the extent of the required down payment is perfectly fine.

Here are some points to remember while availing a loan…

- Know your finances precisely

- Have a clear understanding of your monthly cash flows (cash inflow and outflow). Draw a budget wisely to ensure you don’t go overboard where it could impact your credit score and long-term financial wellbeing.

- Follow the much needed discipline to keep your debt-to-income ratio healthy (Ideally, your monthly debt commitment should not exceed 40% of your gross income).

- Make sure you aren’t compromising and jeopardising your long-term financial goals such as your children’s future needs and your own retirement.

- Have a repayment plan in place

- Ascertain the loan repayment schedule and have a repayment plan in place so that you don’t miss any EMI/s and end up paying a penalty. Therefore, study your income flow and make sure it is consistent (and possibly growing). Account

for emergencies, as life isn’t certain. The only way to mitigate risk is to have a contingency plan in place.

- Ensure you hold adequate insurance

- As a bread winner, while you endeavour to do the best for your family, insure yourself optimally. God forbid, in case of an untoward incidence, the insurance money can aid the financial security of your family members and pay the outstanding

loan.

- Keep your family in the loop

- When you’re planning to avail a loan, make sure you discuss it with your family. Sharing your rationale with them will keep them well-informed and their opinions will help you gain a better perspective. Even it is a surprise,

keeping your family in the dark may not be in their best interest.

Buying a car is life milestone. And today, owing a car is no longer a luxury, but a comfort that is within one’s reach with attractive car loan facility. So, drive home your dream car, live the moments, and make them memorable. Happy driving!

Disclaimer: This article has been authored by PersonalFN, a Mumbai based Financial Planning and Mutual Fund research firm known for offering unbiased and honest opinion on investing. Axis bank doesn't influence any views of the author in any way. Axis Bank & PersonalFN shall not be responsible for any direct / indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information. Please consult your financial advisor before making any financial decision.