- Home

- Business Banking

- Transact Digitally

- Corporate Internet Banking

- Internet Banking FAQs

Corporate Internet Banking - Got a query?

Have any queries with related to corporate internet banking, get them resolved here. FAQs for corporate banking service will help clear all basic information you might require to get started. Go through the below detailed corporate internet banking faqs or you can reach out to us if you might require more help.

Mail your CIB related queries to corporate.ib@axisbank.com or call 18605004971 (charges applicable) or 18004190097 (toll-free) available 24x7.

Corporate Internet Banking

This service is available to any non-individual entity availing Axis Bank’s products and solutions

Axis Corporate Internet Banking comes with a host of benefits like:

- Visibility & access to accounts

- Single Page view of accounts, deposits, loans, cards, etc.

- Visibility to average and projected balances of accounts

- Facility to download account statements in multiple formats

- Security and safe online banking - All transactions are protected by 2-factor-authentication which ensures that only authorised user can complete a transaction

- Option to apply for an Initiator-Approver workflow

- Convenient Financial Transactions

- Flexibility to make fund transfers instantly or schedule one-time payment or schedule recurring payments

- Simplifying salary payments to multiple beneficiaries via a single file upload

- Online shopping across multiple merchants, billers and Tax authorities

- Simple non-financial activities online

- Set transactions as ‘favourites’ for quick access

- Stop payment instructions on issued cheques

- Request for Demand Draft

- Administrative functions

Application Process

The CIB form can be used for below facilities:

- Provide CIB access to existing customers having Current Accounts with the Bank

- Modify details of existing users

a) View access: View-only access will allow users to view the transactions / statement of accounts linked to their User ID. However, they will not be able to transact on these accounts

b) Transaction access: Transaction access will allow users to do transactions on the accounts linked to the User ID. The following type of transaction accesses can be given:

i. Type A: Users can transact only between own linked accounts

ii. Type B: Users can transact between Own linked accounts, Third party accounts, Tax Payments & NEFT/RTGS/IMPS, Online payments (Payment to third party website via Net Banking)

iii. Type C: Users can only make Tax Payments

You can write to corporate.ib@axisbank.com or connect with our Phone Banking team on 18605004971 (charges applicable) or 18004190097 (toll-free) available 24x7. Alternatively, you may also connect with your Relationship Manager or Nodal Branch.

NEFT transactions is available 24x7 on Corporate Internet Banking as per details given below:

- From 7:00 am to 7:00 pm – As per customer approval limit

- From 7.00 pm to 7.00 am - Less Than INR 1 Crore (on working days)

- 2nd and 4th Saturday, Sunday and Bank Holidays-Full Day Upto INR 1 Crore per transaction

RTGS transactions can be initiated 24x7 through Corporate Internet Banking as per below.

- From 7:00 am to 7:00 pm – As per customer approval limit

- From 7.00 pm to 7.00 am - Less Than INR 1 Crore (on working days)

- 2nd and 4th Saturday, Sunday and Bank Holidays-Full Day Upto INR 1 Crore per transaction

IMPS transactions are available 24x7, 365 days on Corporate Internet Banking as per below details:

- The per transaction limit for IMPS is INR 5 Lakhs.

Yes. User can request for specific account access in the CIB application form.

You are required to submit certain documents at any Axis Bank Branch. The documents are as listed below:

Type of User Constitution Documentation applicable as per type of access View Only Authorized Signatory Partnership

Company / LLP

Trust / Society

Government

BanksCIB Form CIBF+Partnerhsip letter (If partner) CIBF+POA (If not partner)

CIBF+Board Resolution

CIBF+Board Resolution

CIBF+Govt. Order

CIBF+Board ResolutionNon-authorized Signatory Partnership

Company / LLP

Trust / Society

Government

BanksCIBF+POA

CIBF+Partnerhsip letter (If partner) CIBF+POA (If not partner)

CIBF+Resolution

CIBF+Resolution

CIBF+letter

CIBF+ResolutionCIBF+KYC+Partnerhsip letter (If partner) CIBF+KYC+POA (If not partner)

CIBF+KYC+Board Resolution

CIBF+KYC+Board Resolution

CIBF+KYC+Govt. Order

CIBF+KYC+Board Resolution*KYC is mandatory for Authorised signatories.

Once the documents are submitted, your request will be processed in 3 working days subject to fulfillment of document scrutiny by bank. You will receive an SMS with details of your Corporate ID and Login ID. In case you do not receive any communication, please contact your Axis Bank Branch/RM for more information. There could be discrepancies in the request submitted

Sample CIB form is available here.

Sample Board Resolution is available here

Sample indemnity clause is available here

CIB has a two-tiered login wherein every corporate customer is issued a Corporate ID and all users under that corporate will be issued a Login ID. In order to access CIB, a user must enter the Corporate ID and Login ID.

For example, Surya working for Vamshi Auto Pvt. Ltd. will use Corporate ID VAMAUT and Login ID SURYA to login.

Corporates cannot alter the Corporate ID issued by the bank. For corporates using CIB for the first time, they may fill up their preferred Corporate ID in CIB form and it will be allotted subject to availability.

User ID can be entered by the user and will be allotted as long as there is no repetition under the same corporate.

Corporate ID and Login ID are not case sensitive, i.e. can be entered in CAPITAL/SMALL LETTERS/BOTH.

- Password should be of at least 8 characters without any space

- It should mandatorily contain alpha-numeric characters

- Should contain at least one Special character

- Following characters are not allowed "()[]@.:;\"

- New password cannot be as same as your previous 3 password(s)

- Don't enter a password same as User name

Profiles for Users in Corporate Internet Banking are as listed below:

- Enterer: can initiate transactions that will need to be approved

- Approver: can approve transactions initiated by others

- Enterer & Approver: can enter and approve transactions singly

- Viewer : can only view accounts and not transact on them

Transaction limits can be set to control CIB usage as per the corporate’s requirements.

For a corporate, the following limits can be set:

- Per transaction limit: Maximum amount up to which a particular user can make a single transaction.

- Daily limit: Maximum amount of transactions that can be done by a specific users under a corporate in a day.

- Corporate Limit: Maximum amount of transactions that can be done by all users put together, under a corporate in a day.

No. The transaction limits can be set as per the requirements of the corporate. If you do not wish to set any limit, fill CIB form as UNLIMITED.

Mobile number and email ID registration are mandatory for all type of users, i.e. maker, checker, viewer etc. NetSecure is a security feature wherein a One-time Password (OTP) is sent to you by the Bank while conducting a transaction. It is a 2 factor authentication which in addition to login ID and password, ensures heightened security for your online transactions.

NetSecure registration is mandatory for initiating financial transactions through Corporate Internet Banking and for online setting/resetting of password. Also Bank shall send security alerts to users. SMS OTP will be provided as default OTP in case not specifically requested for One touch device.

You can avail OTP through:

- SMS – OTP will be sent through SMS to registered mobile number after one time registration.

- OTP on Call : In case you have not received OTP on SMS, OTP on call gets activated. You can click on the link and receive the OTP on call on your registered mobile number.

- One Touch Device - You can generate OTP using the 1-Touch device. The NetSecure with 1-touch device is provided by the Bank at nominal fee of Rs.1000 (plus taxes) per device.

No. All users within a corporate must have unique mobile numbers and email IDs registered for the purpose of security.

Yes. Users can fill-up the international number in the CIB form along with the appropriate Country Code.

You will receive your One-touch device at your registered address within 7 to 10 days. One touch devices are sent through courier, delivery will be as per the courier timelines.

The OTP will expire after120 seconds.

Please contact your Nodal Branch/RM or write to corporate.ib@axisbank.com or call on 18605004971 (charges applicable) or 18004190097 (toll-free) available 24x7.

Yes. Corporates can implement a maker- checker process for greater control over the transactions being made on their accounts. Different profiles can be chosen for each user depending on the role played by them within the corporate.

The number of approvers required for processing transactions by a particular user (Enterer) through Corporate Internet Banking can be defined by entering the information in the space provided for No. of Approver(s) required. Those many users having Approver profile will have to approve the transaction initiated by the Enterer.

For example, if a transaction initiated by a user needs to be approved by two other users, the number of approvers in this case will be 2. A transaction initiated by this user will have to be approved by 2 users with Approver profile.

CIB access is given at Account Level. Account linking is a process where out of the list of accounts pertaining to the corporate, specific accounts are mapped to specific users and this is done as per instructions are provided by the Corporate. Users will only have access to accounts that have been linked to their User ID.

For example, if a corporate has 5 accounts under their customer ID, user A may be mapped to 3 of those accounts whereas user B may be mapped to all 5 accounts.

The CIB form can be used to make any modifications to an existing user under a Corporate setup. Following modifications can be done to an existing set-up using the CIB Form:

- Change User Profile

- Modify transaction limits for the corporate

- Transaction limits for a user

- Update the mobile number and/or email ID of a user

- Switch 2 FA method (SMS/Hard Token)

- Link/delink specific accounts for a user

- Additional features access (Bulk, H2H, Commercial cards, TF Connect, Online FD, etc.)

Customers have to provide Instructions for modifications through a duly filled CIB form at their Axis Bank home branch. For existing users, only the fields that are to be modified should be filled up (Please refer to sample CIB form here).

For list of documents required, please refer the query “What documents should I submit to get CIB access?”

On receipt of the complete set of documents, the request will be processed in 3 working days, subject to fulfillment of document scrutiny by the Bank. To know more about the status of your request, please visit your Axis Bank home branch or contact your Relationship Manager.

You could place a request for deleting an existing user through a filled CIB form at any Axis Bank Branch or through your dedicated Relationship Manager.

Once the form is submitted, your request will be processed in 3 working days. To know more about the status of your request, please visit your Axis Bank home branch or contact your Relationship Manager.

All account mapped to the Authorizer will be mapped to the Maker / Viewer created.

No, you can neither create, nor modify users with ‘Authorizer’ rights. You will have to visit Axis Bank branch or contact your Relationship Manager for the same.

You will be required to reset your login password every 90 days to continue accessing Corporate Banking facilities.

You can change your password from the 91st day till the 180th day to access Corporate Banking facilities. Your account will be temporarily deactivated after 180 days. You will need to contact your Relationship Manager (RM) / nearest branch to reactivate.

You will receive a pre-intimation alert from the Bank from the 85th day till the 90th day and from the 175th day till the 180th day to change your login password. On the 181st day, you will receive an alert of account disablement. Please ensure that your email ID and mobile number registered with Corporate Internet Banking platform are updated in the Bank’s records for receiving alerts.

You are required to change your password every 90 days to ensure the security of your internet banking access.

Yes, you will receive alerts on your registered email and mobile number from the 85th to the 90th day after your last password change, reminding you to update your password. You will also see a prompt on the Corporate Internet Banking portal when you log in. Additionally, you will receive a final alert on the 91st day, by which password change becomes mandatory.

A user will be marked inactive if they do not log in to the Corporate Internet Banking web portal or mobile app for 180 consecutive days. In such cases, access will be locked due to inactivity.

Yes, you will receive notifications via email and SMS on your registered email and mobile number between the 175th and 180th days, prompting you to log in and reset your password. A final notification will be sent on the 181st day once your access to Corporate Internet Banking is locked.

Please visit your branch or contact your Relationship Manager and submit a request letter to reactivate your account. The request letter must be signed by the authorized signatory.

Status Enquiry

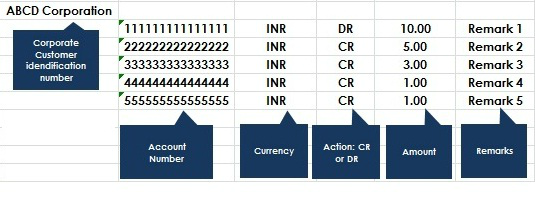

Step 1:- Create an excel sheet as per the below format mentioning the Salary detail.

Please note:

- All contents except the salary amount should be in “text format”

- Salary amount should be in “number format” upto 2 decimals

- Recommended Excel format: 97- 2003

- Total Debit amount should be equal to total credit amount

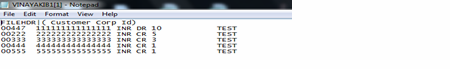

Step 2:- Please convert the Excel sheet into Text Format by using the below link.

https://www.axisbiconnect.co.in/FileConverter/SalaryUpload.aspx

The file has now been converted into “Text format”

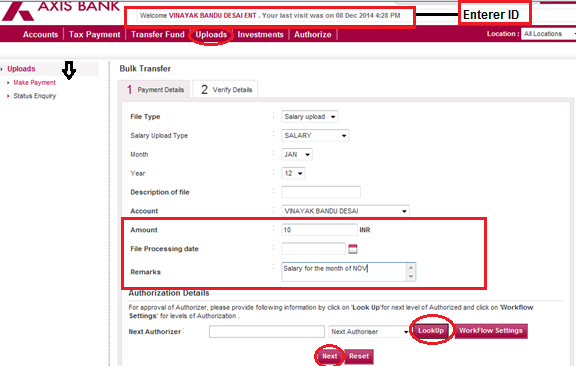

Step 3:- Please log on to Corporate internet Banking and login using the “Enterer” ID, Click on the UPLOADS option and click on “ Make Payments” .

Here you have to fill up all the details like:

- Amount

- Remark

- File Processing date (In case of scheduling a file), Month and Year.

- Then click on the Look Up button for next level of authorization. You may click Work flow settings button for levels of authorization for selecting the authorizer.

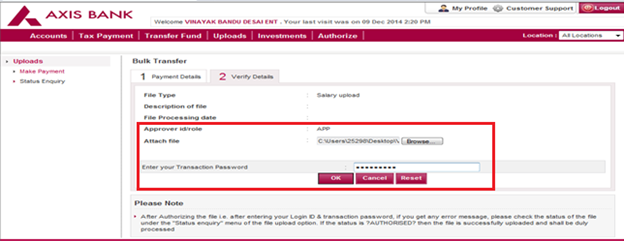

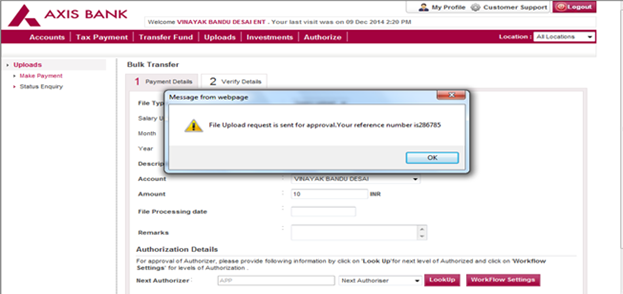

Step 4:- Once all the details are correctly filled, click on “NEXT button” to browse the saved converted text file, enter the transaction password and click on “OK” button

A confirmation window would appear with the reference number.

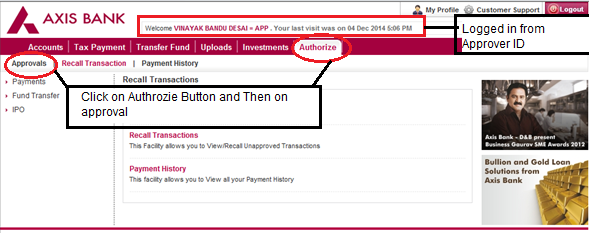

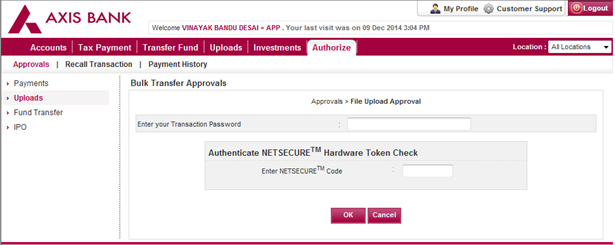

Step 5:- Please log out as ENT and log in with the approver user id and password, click on the Authorize option -----> Approvals.

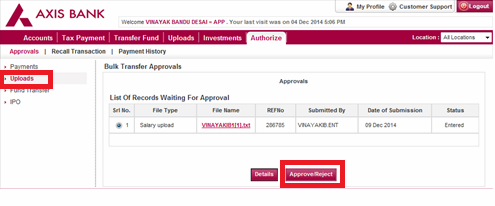

Step 6:- Click on Uploads, you would notice the bulk transfer approval details. Select the transaction and click on Approve/Reject button.

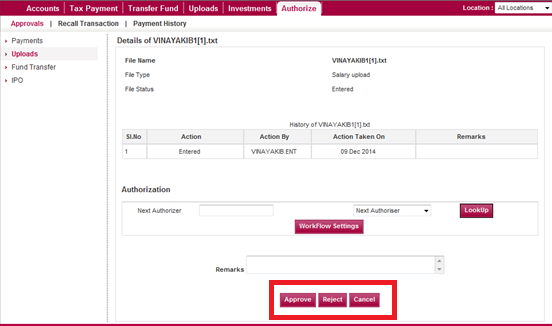

Step 7:- Then you have to click on the APPROVE button or REJECT button.

Step 8:- Enter your transaction password, Netsecure Code and click on the OK button to process the transaction.

Quick Tips

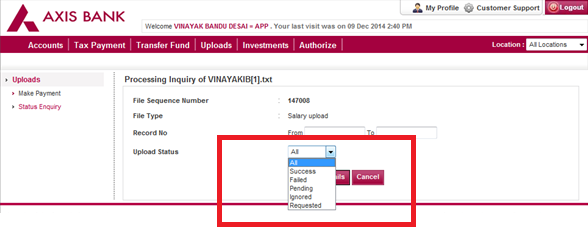

- You can check the status of your transactions through the “Status Enquiry” option

Corporate Internet Banking (CIB) can be used to make the following transactions:

- Axis to Axis fund transfer

- NEFT

- RTGS

- IMPS

- Tax Payments – Central and State click to view taxes payable via Axis Bank

- Shopping mall transactions click to view list of merchants

- Salary upload

CIB can also be used to raise the following requests:

- Online password generation

- Statement generation

- Demand Draft request

- Cheque Book request

- Stop Cheque request

- View FD accounts

- View Accounts , balances and Download statements

- View and pay commercial cards

- Submit request to update PAN

Salary files can be uploaded using CIB 24/7.

You can check the status of the transactions in ‘Transaction Status Enquiry’ option.

- Stop Transaction – This helps you Stop Transactions that have already been approved

- Recall Transaction – This option helps you recall transactions before approval

- Modify Transaction – This helps you Modify details of transactions that have already been approved

- Copy Transaction – This helps you copy transaction details to make similar payments again

- Set as Favourite Transaction – This helps you to set transactions as favourite to make the same payment

Yes, you may schedule a transaction by entering a future date while making a transaction. It will be executed on the day specified.

The transactions should be approved within the following period, else they will become expired:

- EPFO – on the same day

- Other transactions - within 10 days

- Salary – within the value date

- Payee Addition – within 10 days

- GST Payment – within 7 days

- Shopping Mall – on the same day

- Limit consumed for the day

This implies that the ‘per day limit’ of the User or Corporates has exhausted. Kindly submit a request to enhance the limit along with the following documents: Board Resolution, CIB Form. For CC/OD accounts please contact your Relationship manager or Nodal Branch.

- You are not authorized to approve this transaction

As per workflow defined for each corporate, a particular user may not have the rights to approve transactions beyond a set amount. Authorizers belonging to a different group will have the necessary powers to approve such transactions. You may modify your workflow by submitting the following documents: Board Resolution, CIB Form

A CIB user can add up to 20 Payees per day.

Payee added in CIB will be activated after a cooling period of 30 minutes. Payee added after 8 PM will be activated at 8AM on next day.

Tax Payments

CIB can be used to make the following tax payments:

Central taxes

- GST

- CBDT

- Excise Duty and Service Tax

- State Taxes

For more information, please click hereFor'Taxes'.

- Login to your GSTN portal. Create a challan by entering required details and choose Axis Bank. To check the complete process click hereFor'Goods and Services Tax (GST)'.

Below payments modes will be available on TIN 2.0 for Direct Tax Payments

- Internet Banking Corporate Internet Banking (CIB) and Retail Internet Banking (RIB)

- Pay at Bank Counter through Axis Bank Branches

- NEFT/RTGS

Direct Tax Transactions under Minor Head codes – 100 - Advance Tax, 200 – TDS/TCS (other than TDS on Sale of Property) and 300 - Self-Assessment, can be initiated directly from Axis Bank CIB channel via Bulk file upload. For Direct Tax payment of Minor Head codes other than 100, 200 and 300, the customer will have to initiate the transaction from TIN 2.0 portal. [Click here to view Annexure – I for detailed description on minor codes & major codes]

- The customer will have to visit the TIN 2.0 Income Tax Portal using the link- Click here

- TIN 2.0 has a pre-login section which can be accessed by the tax payer by entering their PAN/TAN along with the Mobile Number and OTP. Through this section, few type of Direct Tax transactions can be initiated. Link for pre-login section- Click here

- Additionally, TIN 2.0 also has a logged in section which can be accessed by the tax payer by entering their PAN/TAN and password. Through this section, all types of Direct Tax transactions can be initiated. Link for login section- Click here Click here

The customer will have to visit the TIN 2.0 Income Tax Portal using the link- Click here

Below channels will be available to a corporate customer for Direct Tax payments under TIN 2.0

- Net Banking through TIN 2.0 portal

- Bulk CBDT through CIB directly (minor codes 100, 200 and 300 only) [Click here to view Refer Annexure – I for detailed description on minor codes & major codes]

Below channel is available to a retail customer for Direct Tax payments under TIN 2.0

- Net Banking through TIN 2.0 portal

Yes, two factor authentication (OTP) will be required to process Direct Tax payments.

The customer needs to login to TIN 2.0 portal for downloading challans for the Direct Tax payments processed successfully through any mode. TIN 2.0 login link and path to download challan is as below – Path: login to portal >> e-file >> E-pay tax >> Payment History >> Action >> Download

The registered email id of the PAN/TAN shall also receive a challan copy from Income Tax Department directly.The transaction report along with status of CBDT transactions can be downloaded by Corporate customer from our CIB platform.

Login to CIB >> Status Enquiry >> Tax Payment >> CBDT >> Enter the relevant period and proceed.In case the customer has initiated a Direct Tax transaction from TIN 2.0 portal, the customer will be auto-redirected back to TIN 2.0 portal, after payment is completed, for downloading challan.

In case the customer has processed transaction directly from Axis Bank Bulk CBDT channels, the customer will have to login to TIN 2.0 portal, after payment is completed, for downloading challan.Yes, Bulk File upload is available for customer in TIN 2.0 also. Upload file can cater to transactions of minor head code 100 (Advance tax), 200 (TDS) and 300 (Self-Assessment) only. [Click here to view Annexure -1 for details on minor & major codes]

No, the file format is made simple and easy to understand. The sample file format is available on our Bulk CBDT platform for ready reference to our clients.

Through Bulk file upload in CIB, 1000 transactions per file can be processed at once for Direct Tax payments under minor code 100, 200 and 300 only. [Click here to view Annexure -1 for details on minor & major codes]

Yes, Checker can view the details of the file uploaded by maker with all the transaction particulars before approving. Checker to login to CIB – Approvals Due – CBDT approvals – Select the file and proceed.

Customer can download the sample file format for processing of Direct Tax transactions through Bulk file upload in CIB by using the below path – Login to CIB >> Payments >> Tax Payments >> Bulk CBDT >> Sample file download

Customer can upload bulk file for processing of Direct Tax transaction on CIB by using the below path – Login to CIB >> Payments >> Tax Payment >> Bulk CBDT >> Browse and select the file –upload and proceed

The checker/ authoriser can approve a Direct Tax transaction through Bulk file upload on CIB by using the below path – Login to CIB >> Approvals Due >> CBDT approval >> Select and view the details >> Authorise

26QB, 26QC and 26QD will be initiated from login section on TIN 2.0 portal and hence this can’t be part of bulk upload

While generating a challan on TIN 2.0 portal for payment of Direct Tax, the customer needs to select the option of “Pay at Bank Counter” from the payment modes available on the portal.

Will clearing cheques also be accepted at Axis Bank branches for payment of Direct Tax transactions?

Yes, Non-Axis Bank’s Cheque and DD can be accepted at GBM enabled branches.

Direct Tax Challan will get expired in 15 days before which the transaction needs to be successfully completed. In case, the payment is not completed within 15 days, the generated challan will expire and the customer will need to reinitiate a fresh transaction.

No modifications/ rectifications, whatsoever, can be done in the transaction details/ challans after the payment has been successfully processed. Tax Payer may connect with Income Tax Department for such requests and follow their prescribed guidelines.

Bank will not be able to undertake any refund or reverse the funds once the payment for Direct Tax transaction is successfully processed. Tax Payer may connect with Income Tax Department for such requests and follow their prescribed guidelines.

In case the account has been debited but the transaction status is still showing as pending, the customer is suggested to wait for 30-45 minutes for the transaction status to get updated.

In case the transaction status has been confirmed as success by the bank but is still showing as awaiting bank’s confirmation on TIN 2.0 portal, the customer is suggested to wait for 30-45 minutes for the transaction payment status to get updated.

In this exception scenario, the customer is suggested to wait for 30-45 minutes for TIN 2.0 portal to update the status. However, in case of further delay customer should contact TIN 2.0 customer care – For details Click here

No, the system will not accept the decimal value in amount.

Shopping Mall Payments

Shopping Mall Payment is the facility offered by Axis Bank Corporate Internet Banking that lets you make online payments at various merchant websites. You can use your Axis Bank Current account to make online purchases at these merchant websites. Whether it is shopping online, making tax payments, making travel bookings, paying at educational institutes, buying insurance, buying investments, paying utility bills, making payment to government websites for various services, choose Axis Bank Corporate Internet Banking at any website or app to enjoy hassle-free and secure payments.

- Visit any of the merchant websites. (Example – http://www.xyz.in/)

- Select the product or service that you would like to pay for

- From the payment options offered by the merchant website, Select Axis Bank Corporate Internet Banking as the payment option during checkout at any site or app.

- On selection, you will be directed to the Axis Bank Corporate Internet Banking website.

- There will be two types of users who can process the transactions the following way:

A. Having separate initiators and authorizers (Maker Checker Flow)

i. The initiator will login to AXIS Bank Corporate Internet Banking and Select the account through which user wishes to make the payment and confirms the transaction.

ii. The transaction will get accepted and user will be redirected to the merchant website where “Pending for Approval” status will be shown.

iii. The authorizer will then login to AXIS Bank Corporate Internet Banking and approve the transaction.

iv. The purchase amount will get debited from the account and the transaction is complete.

By default, transactions initiated by initiator will get expired on the same day midnight (11:59:59).

B. Having the same initiator and authorizer (Real Time Flow)

i. The user with both maker and checker rights will login to AXIS Bank Corporate Internet Banking and Select the account through which user wishes to make the payment and confirms the transaction.

ii. After the purchase amount is debited from the account, user will be redirected to the merchant website to complete the purchase.

To View the Merchant List : Go to Axis Bank CIB login Page --> Select CIB Downloads under Useful Links --> Select Merchant List for Shopping Mall Transactions

No, few of the merchant websites don’t support Maker checker flow for making payments. On such websites where only real time flow is accepted, users having both maker and checker rights will only be able to complete the transaction. To view which websites support real time or maker checker flow, please click hereFor'Merchant List for Shopping Mall Transactions'

Yes, by default the transactions initiated by initiator will get expired on the same day midnight (11:59:59). So authorizer has to approve the transaction same day by midnight (11:59:59).

Initiator will have to again initiate the transaction by visiting merchant website and then then it will be available in authorizer’s pending for approval queue again to approve the transaction.

If the merchant is not present in the list, please share the following with corporate.ib@axisbank.com" target="_blank" >corporate.ib@axisbank.com.

We will check with the merchant to update CIB payment option and update you.

- Merchant website URL

- Stepwise screenshots of the complete transaction journey i.e from the starting of the services selected on the merchant website to the end of the payment gateway page in which CIB Payment option is not available.

Note: - Payment gateway page with list of banks under Internet Banking tab screenshot is a must. This will help us in enabling CIB payment option on the merchant website faster.

To check if your account has been debited or not, you need to login to the Corporate Internet Banking and check your account statement for that transaction.

Yes, your Merchant transactions are subject to the daily default limit set for your account in the CIB.

Online Password Generation

- CIB password can be generated using the Green Pin option available on the login page.

- On the CIB pre-login page, select ‘Set/Reset password’ option.

- Enter the following fields for authentication:

- Corporate ID & User ID (received via SMS for new users)

- Registered mobile number (Entered at the time of form filling)

- Official email ID (Entered at the time of form filling)

- On successful validation, an email with unique URL link is sent to your registered official email ID. (Validity of the URL link is 30 minutes only. If link expires, user needs to re-initiate the process from Step 1, by clicking on ‘Set/Reset Password’ option)

- On clicking the link received via email, you will be led to “Generate Password” page. Then, one of the following options should be selected:

- Set Login password

- Set transaction password**

- Set both login and transaction password

- Enter the desired password, complying with the rules displayed to set a valid password. Re-enter to confirm the new password & click “Submit”.

- CIB prompts to enter the OTP received on registered mobile number to authenticate the user who has accessed the “Generate password” page.

- CIB page displays acknowledgement message confirming successful generation/reset of password. You may instantly login to start using CIB.

- The password generated via Green pin can be used with immediate effect and NEED NOT be changed during first login

Note: During process of password generation/reset, if incorrect credentials are inputted five times, CIB disallows further attempts till end of day and the same is communicated through a message on the screen. However, you can retry after 12 am.

**Applicable only for user with transaction rights

Note: Users with transaction access may choose to generate one of the two passwords later, viz., login password & transaction password (i.e. User may repeat the same process, to generate the other password later, if required)

- Login password - This is required for logging in to Corporate Internet Banking and to view account details.

- Transaction Password - This is required for initiating transactions like fund transfers, bill payment, service requests etc

New users requesting CIB access will automatically receive their Corporate ID and User ID via SMS and Email for generating Login password online. SMS and Email will be sent to the Registered Mobile Number (RMN) and Email ID as per the CIB form. You can also use the Unlock ID option.

As a security feature, the Bank will lock password if multiple incorrect attempts are made.

- Login Password - In case of 5 incorrect login password entries, the system disables the password for the calendar day. It will be enabled the next calendar day

- Transaction Password - In case of 10 incorrect transaction password entries, the system locks your transaction password for the calendar day.

Security & Safe Banking

CIB provides multiple layers of protection to secure your online banking experience:

- 128-bit encryption to keep your transaction safe.

- Two levels of passwords (Login and Transaction) to provide enhanced security to all your transactions.

- Second factor authentication in the form of NETSECURE code for carrying out all financial transactions.

- Corporates also have the option to apply for an Initiator and Approver facility for all financial transactions.

If you suspect any unauthorized transaction in your account, please write a mail to corporate.ib@axisbank.com or call on 18605004971 (charges applicable) or 18004190097 (toll-free) available 24x7. Alternatively, you may also contact your Branch or Relationship Manager.

To protect your account from fraud please take care of the following:

Keep your passwords secret and change them often – Do not share your passwords or NETSECURE codes with anyone. Change your passwords often. Changing passwords often helps in protecting your account even if inadvertently you may have disclosed it to someone. You can change your login and transaction password from My Profile section after logging in.

Make your password difficult to crack – Axis Bank has created protocols for setting passwords to keep your passwords safe. In addition, when you create your password, do not make it similar to your user ID or any other information that is easily available. This will ensure that the passwords are very difficult to crack.

Avoid using cyber cafes to access your internet banking accounts - PCs at cyber cafes may be infested with viruses and Trojans that can capture and transmit your personal data to fraudsters. The easiest way to grab information is key logging software, which records all the keystrokes you typed, to be retrieved later for fraudulent usage. Beware of typing passwords on unknown PCs.

In case you have used a cyber cafe for accessing your account, ensure to do the following:

- Always use the virtual keypad to type in your password.

- Don't leave the computer unattended after logging into Axis Corporate Internet Banking.

- Always log out of Axis Corporate Internet Banking by clicking "logout" on the website.

- After logging out, close all the windows and clear the cache of the browser.

Keep your computer secure - Some phishing emails or other spam may contain software that can record information on your Internet activities (spyware) or open a 'backdoor' to allow hackers access to your computer (Trojans).

Installing anti-virus software and keeping it up to date will help detect and disable malicious software, while using anti-spam software will stop phishing emails from reaching you. It is also important, particularly for users with a broadband connection, to install a firewall. This will help keep the information on your computer secure while blocking communication from unwanted sources.

Make sure you keep up- to-date and download the latest security patches for your browser. If you don't have any patches installed, visit your browser's website, for example users of Internet Explorer should go to the Microsoft website.

Check the website you are visiting is secure - if the address bar is visible, the URL should start with 'https://' ('s' for secured) rather than the usual 'http://'. If the address bar is not visible as in our Internet Banking website, look for a lock icon on the browser's status bar.

Validate the SSL Certificate - If you are in any doubt, click on the lock icon at the bottom of the secured page. This opens up a new window, displaying the SSL certificate information. Ensure that there is no Red Cross mark preceding the title 'Certificate Information'.

To ensure that you remain protected at all times

- Never let anyone know your PINs or passwords

- Do not write them down

- Do not use the same password for all your online accounts

- Avoid opening or replying to spam emails, as this will give sender the confirmation that they have reached a live address.

Never respond to emails that request personal information - At Axis Bank, we would never ask for your personal details through an email, nor would we ask for your password through any means, phone, fax or in-persons. If any of our bank personnel asks you for your password, do not disclose it and report him or her immediately to us. If you do not recognize an amount charged to you, please report the same in writing to Axis Bank immediately.

In case you suspect an email claiming to be from Axis Bank is fraudulent, please report it to the Bank immediately at corporate.ib@axisbank.com

Note that the fact that the website is using encryption doesn't necessarily mean that the website is legitimate. It only tells you that the data is being sent in encrypted form.

Customer grievances can be raised here.

Please contact our Customer care team on 1860-500-4971 or mail us at corporate.ib@axisbank.com.

As an additional security during CIB login, Captcha is available when incorrect credentials are entered to safeguard the user access against BOT attacks & fraudulent practices.

Yes, you will now get alerts on your registered email ID & mobile number in case of incorrect attempts during CIB login.

Please ensure that your email ID and mobile number are updated with the bank.The consent popup is required as part of your confirmation towards information on the product, secure usage guidelines and Terms and conditions applicable for CIB.

You can report fraudulent transaction/s by initiating “Mark a Fraud” option on

- Corporate Internet Banking (CIB) platform & the Axis Mobile Corporate app (CMB)

- Customers can also reach out to the Corporate Customer Care team by writing at corporate.ib@axisbank.com or calling 18605004971 (charges applicable) or 18004190097 (toll-free) available 24x7.

Only Approver/s can initiate “Mark a Fraud” for transaction/s on CIB / CMB

- Notification via email will be sent to all authorised signatories once an online transaction/s is reported as “Mark a Fraud”

- All the set ups in CIB / CMB linked with the account will be disabled by the Bank for investigation purposes for up to 90 days

- User will further not be able to repair, modify, copy or mark the said transaction/s as favourite

- Till the investigation is entirely completed, no further online transaction/s can be carried out from the disabled setups

- In case of any scheduled / recurring transaction/s, it will be cancelled by the Bank and the customer will have to initiate fresh transaction/s

You will not be able to log into Corporate Internet and Mobile Banking platform as the ID will be disabled.

You will be required to submit a request letter from the authorised signatories to your Branch or Relationship Manager (RM) or send out an email to corporate.ib@axisbank.com from an authorized signatories to the Corporate Customer Care team. Post verification, set-up will be enabled by the Bank.

Post completion of entire investigation at the Bank’s end, set-up linked with the account will be enabled.

Temporary credit will be provided by the bank during investigation. If the transaction/s is identified fraudulent while undergoing investigation, then the final or the amount which was transacted by the customer will be credited to the account after completion of entire investigation.

You can initiate “Mark a Fraud” only for Single Payment transaction/s (NEFT, RTGS, IMPS, FT payments) initiated from CIB and CMB.

- After logging into CIB, click on ‘Single payments’ option under ‘Status Enquiry’ tab

- Enter the transaction details and select the transaction for which the dispute is to be raised

- Click on ‘Mark a Fraud’ option under 3-dot menu

- A confirmation pop-up will appear. Click on ‘Proceed’ to continue.

- Success message will appear along with Dispute ID and an email will be sent to the approvers of authorisation matrix regarding disputed transaction

During payee addition, after entering payee account number and IFSC code, the beneficiary name as per the payee bank will be displayed to you. During payment initiation, clicking ‘Verify Payee’ will also display the beneficiary name.

Yes, it is mandatory during payee addition but optional during payment initiation for an already added payee.

Yes, while the beneficiary’s name as per the payee's bank will be shown, you can assign a name and nickname of your choice in Internet and Mobile Banking.

No, verify payee option is free and available for all customers.

Yes, verify payee option is available during payment initiation for an already added payee at any time.

No, it is available only for single vendor payments.

The National Cyber Reporting Platform (NCRP) refers to the National Cybercrime Reporting Portal, an initiative by the Government of India to facilitate the online reporting of cybercrimes. It enables citizens to report various types of cybercrimes—including those targeting women and children— and track the status of their complaints. The portal is managed by the Indian Cybercrime Coordination Centre (I4C) under the Ministry of Home Affairs.

To alert customers about potential risks when transferring funds, the system will display a pop-up warning whenever a customer attempts to add a beneficiary or make a payment to a beneficiary listed in the NCRP database.

Yes, both the Maker and the Checker will be notified.

Yes, it is at the discretion of the customer (Maker/Checker) to proceed with adding the beneficiary or making the payment, even if the beneficiary appears in the NCRP database.

Unified Dispute and Issue Resolution (UDIR) is a system developed by the National Payments Corporation of India (NPCI) to streamline and automate the resolution of disputes and issues related to digital payment transactions, particularly within the IMPS ecosystem.

IMPS transactions (in Corporate Internet Banking) which have their status as “Status Awaited” are eligible for raising a dispute.

The "Raise a Dispute" option is available for T+59 days, i.e., within 60 days from the transaction approval date (excluding holiday restrictions), provided the transaction status is "Awaited." Here, T refers to the date of the transaction.

The customer will receive details of the dispute via SMS and email. The status of the dispute can be tracked using the "Track Dispute" option, which becomes available once the dispute is raised.

The checksum for the Axis Mobile - Corporate app version acts like a unique security seal. It ensures that the app you’ve downloaded is the genuine, untampered version from Axis Bank— not a fake or modified one. This helps protect you from malware and fraud.

No action is required from your side. Checksums operate silently in the background to verify the authenticity of your app. You won’t need to view or interact with them. Just ensure you enter your details accurately—like your account number—and rest assured that the app’s built-in security features are working continuously to keep your transactions safe.

You can login to your Axis Mobile - sCorporate mobile app and follow the below steps:

- Click on the menu icon in the top-left corner of the dashboard.

- Select the checksum option.

- You’ll see the checksum for your app version

- You can validate it by clicking the link provided in the app or visiting: https://www.axisbank.com/Bank-Smart/Axis-Mobile-Corporate/Checksum

To ensure you're using the latest secure version:

1. On Android: Open the Google Play Store → Tap your profile icon→ Manage apps & device → Check for updates under Updates available

2. On iOS: Open the App Store → Tap your profile icon → Scroll to see pending updates.Always download updates only from official app stores to avoid counterfeit apps.

Regular updates provide:

- Security patches to protect against new threats

- Bug fixes for smoother transactions

- New features like enhanced fraud alerts.

Outdated apps may have vulnerabilities. For your safety, enable auto-updates in your app store settings.

The user needs to enable the mPIN functionality on the Neo for Corporates app to generate an OTP on their mobile device.

- Users can generate OTPs anytime and from anywhere via the neo for corporates

- No need to carry one-touch devices for transaction approval

- Serves as an alternative to SMS OTP and on-call OTP Highly secure with features like SIM binding and mPIN authentication

- Can be used for login and transactions on the web and mobile browser

- mPIN should be enabled for the user

- Open the Neo for corporates App

- Click on ‘Generate OTP’ on the pre-login screen

- Enter the ‘mPIN’ and submit

Any user who is registered on the neo for corporates App and has enabled mPIN can use this feature.

The ‘Generate OTP on mobile’ option can be used only for login and for initiating transactions on both web and mobile browsers.

No, the user must enable mPIN on the Neo for corporates app to use this functionality.

No, OTP generation will work only for the User ID mapped to the registered mobile number. Authentication for different login IDs and mobile numbers is restricted.

Yes, generating OTP on mobile is secure due to the SIM binding and mPIN authentication process. OTP is generated only after mPIN authorisation on the mobile.

1. Immediately contact Corporate customer care team on 1860 500 4971 (chargeable) or 1800 491 0097 (tollfree) / write to corporate.ib@axisbank.com or your branch/ relationship manager to disable the access CIB.

3. Report the loss to your mobile operator to block the SIMLogin Issues

- Got to the CIB login page and click on Instantly Generate/Change Password

- Click on Proceed on the instructions page

- In the Please Note section, click on Having trouble in generating / changing password?

- Fill your details in the form and click on Submit

Please contact our customer care team on 18605004971 (charges applicable) or 18004190097 (toll-free) available 24x7 or mail at corporate.ib@axisbank.com

You can report fraudulent transaction/s by initiating “Mark a Fraud” option on

Corporate Internet Banking (CIB) platform & the Axis Mobile Corporate app (CMB)

Customers can also reach out to the Corporate Customer Care team by writing at corporate.ib@axisbank.com or calling on 18605004971 (charges applicable) or 18004190097 (toll-free) available 24x7.Kindly advise your IT team to whitelist the sender email ID *@axisbank.com to avail online password reset facility.

Please try Set/Reset Password Link after the domain ID has been whitelisted at your end. If you are still facing issues, please write a mail to corporate.ib@axisbank.com or call on 18605004971 (charges applicable) or 18004190097 (toll-free) available 24x7.

Alternatively, you may also contact your Branch or Relationship Manager.

Submit a written request letter to your Branch / Relationship Manager.

Transaction password is only required for users with transaction access. It will not be applicable for user with View-only access. Please get your access type checked from your Axis branch

In case you exceed the maximum number of permissible incorrect attempts, the account will get deactivated. Please submit written request at your Axis branch or to your RM signed by the authorized signatory.

You can click on Set/Reset password on CIB login page to set your new password.

You can unlock your credentials using ‘Trouble logging in? > Unlock Account’ on the login page of Corporate Internet Banking. Further, enter your Corporate ID and Login ID, authenticate and submit.

You can go to ‘Trouble logging in? > Get your login details’ on the login page of Corporate Internet Banking. Fill in your registered Email ID, Country and Registered Mobile Number (RMN) and proceed. Post submitting, your credentials will be sent to your Registered Email ID.

Mobile Application

Yes, Axis Mobile Corporate is available for both iOS and Android mobile users. To know more details about the mobile app, please click here.

Account Statement Download

a) Select the ‘View More / Detailed Statement’ option from the Corporate Internet Banking homepage.

b) Choose from ‘Domestic Account’ or ‘Other Account’ to see the account balance OR search the account with account number from the search tab.a) After viewing the account balance, select the account for which you want to download the statement.

b) Select the Transaction Date Range or Period.

c) Select the display format and click on ‘GO’ button.The statement can be downloaded in the following formats:

- XLS

- CSV

- TXT

- MT940

The statement can be downloaded for a period of last 3 months or 90 days.

You can view Transaction Date, Value Date, Transactions Particulars, Cheque Number, Amount (INR), Debit / Credit and Balance (INR) and Branch name.

- Log in to CIB

- Click on View More/Detailed Statement

- Select the account for which you require the statement:

- In the drop-down menu “Select Display Format”, select MT-940 as statement type and then click on ”GO”

Status Tag Field Name Content/Options M 20 Transaction

Reference Number16x O 21 Related Reference 16x M 25 Account

Identification35x M 28C Statement

Number/Sequence

Number5n[/5n] M 60a Opening Balance F or M O 61 Statement Line 6!n[4!n]2a[1!a]15d1!a3!c16x[//16x] [34x] O 86 Information to Account Owner 6*65x M 62a Closing Balance (Booked Funds) F or M O 64 Closing Available

Balance

(Available Funds)1!a6!n3!a15d O 65 Forward Available

Balance1!a6!n3!a15d O 86 Information to

Account Owner6*65x CODES

When the first character of subfield 6 Transaction Type Identification Code is 'N' or 'F', the remaining characters may contain one of the following codes:

BNK Securities Related Item - Bank fees

BOE Bill of exchange

BRF Brokerage fee

CAR Securities Related Item - Corporate Actions Related (Should only be used when no specific corporate action event code is available)

CAS Securities Related Item - Cash in Lieu

CHG Charges and other expenses

CHK Cheques

CLR Cash letters/Cheques remittance

CMI Cash management item - No detail

CMN Cash management item - Notional pooling

CMP Compensation claims

CMS Cash management item - Sweeping

CMT Cash management item -Topping

CMZ Cash management item - Zero balancing

COL Collections (used when entering a principal amount)

COM Commission

CPN Securities Related Item - Coupon payments

DCR Documentary credit (used when entering a principal amount)

DDT Direct Debit Item

DIS Securities Related Item - Gains disbursement

DIV Securities Related Item - Dividends

EQA Equivalent amount

EXT Securities Related Item - External transfer for own account

FEX Foreign exchange

INT Interest

LBX Lock box

LDP Loan deposit

MAR Securities Related Item - Margin payments/Receipts

MAT Securities Related Item - Maturity

MGT Securities Related Item - Management fees

MSC Miscellaneous

NWI Securities Related Item - New issues distribution

ODC Overdraft charge

OPT Securities Related Item - Options

PCH Securities Related Item - Purchase (including STIF and Time deposits)

POP Securities Related Item - Pair-off proceeds

PRN Securities Related Item - Principal pay-down/pay-up

REC Securities Related Item - Tax reclaim

RED Securities Related Item - Redemption/Withdrawal

RIG Securities Related Item - Rights

RTI Returned item

SAL Securities Related Item - Sale (including STIF and Time deposits)

SEC Securities (used when entering a principal amount)

SLE Securities Related Item - Securities lending related

STO Standing order

STP Securities Related Item - Stamp duty

SUB Securities Related Item - Subscription

SWP Securities Related Item - SWAP payment

TAX Securities Related Item - Withholding tax payment

TCK Travellers cheques

TCM Securities Related Item - Tripartite collateral management

TRA Securities Related Item - Internal transfer for own account

TRF Transfer

TRN Securities Related Item - Transaction fee

UWC Securities Related Item - Underwriting commission

VDA Value date adjustment (used with an entry made to withdraw an incorrectly dated entry - it will be followed by the correct entry with the relevant code)

WAR Securities Related Item – Warrant

Positive Pay

Positive Pay System (Refer RBI Circular No. DPSS.CO.RPPD.NO.309/04.07.005/2020-21) enables an additional security layer in cheque clearance wherein the issuer (drawer) of the cheque shares the cheque details with the bank. When the beneficiary submits the cheque for clearing, the presented cheque details will be compared with the details provided to the Bank through Positive Pay.

The user can avail Positive Pay System if he/she has drawn a cheque for ₹50000/- (Fifty Thousand) or more.

This feature is only mandatory for cheques with amount ₹5,00,000/- or above.

The cheque details that need to be shared are as under:

- Account Number (15 digits Axis Bank Account Number)

- Cheque Number (6 digits)

- Cheque Date (Date mentioned on the cheque)

- Cheque Amount

- Name of Beneficiary (Payee’s Name)

Customers can share the cheque details with the bank through below channels:

- Mobile Banking

Customers can share the cheque details through Mobile Banking under the path: Services >> Cheques >> Positive Pay. On successfully registration, reference number will be generated.

- Internet Banking

Customers can share the cheque details through Internet Banking under the path: Services >> Positive Pay. On successfully registration, reference number will be generated.

- Positive Pay details can be submitted by the account holder (drawer) from the convenience of home through Mobile / Internet Banking.

- Details shared by the account holder will be validated & updated in Positive Pay data base at National Payments Corporation of India (NPCI).

- SMS will be sent to the customer’s registered mobile number, to acknowledge receipt of Positive Pay details.

- When cheque is received in CTS inward clearing, the presented cheque details will be compared with the details provided to the Bank through PPS.

- In case of data discrepancy, the cheque will be returned unpaid after referring to the customers through home branch.

Customer need to share the Positive Pay details immediately after the cheque has been issued or one working day prior to cheque presentation.

In case of data discrepancy, the cheque will be returned unpaid after referring to the customer through home branch. Insufficient and incorrect details may also lead to cheque return.

Fixed Deposit

Minimum amount for Fixed Deposit creation is INR 5,000 and maximum amount limit is as per the corporate transaction limit

FD can be created for a minimum period of 7 days.

There's no specific period. Pre-mature withdrawal of FD is available *

*FDs can be withdrawn if they are created via Corporate Internet Banking (CIB) only.Yes. You can opt to reinvest (auto-renew) under “Maturity Instruction” under Fixed Deposits.

To enable Online FD facility in CIB, Corporate has to submit a Request Letter at their Axis Bank branch or to their Relationship Manager (RM).

FDs created online will be linked automatically to the Maker and the Checker (Checker should have a Customer ID level access).

FDs created via branch will be linked as follows:

- Customer ID-wise access: View all existing and new FDs in CIB on T+1 basis.

- Account- wise access: View only specific FDs which are linked to the User. FDs created via branch:

Non-withdrawable Fixed Deposits (Fixed Deposit Plus)

Non-withdrawable Fixed Deposit represents a secure investment avenue where the funds are locked in until the end of the maturity period without the option for early withdrawal. This type of Fixed Deposit often demands a larger initial investment but offers more attractive interest rates in return, as the capital is guaranteed to remain untouched until maturity.

Non-withdrawable Fixed Deposit offers the dual benefits of investment security and attractive returns, making it an ideal choice for investors seeking a stable growth path for their savings.

Guaranteed higher yields: The main advantage of a non-withdrawable Fixed Deposit is the assurance of receiving the full maturity amount, which can result in higher interest earnings than what you might expect from a normal Fixed Deposit.

Restricted withdrawals for enhanced security: In contrast to normal Fixed Deposits, non-withdrawable Fixed Deposits strictly limit withdrawals to extremely rare circumstances like bankruptcy/winding up/ directions by court/regulators/receiver/liquidator/deceased cases. Terms and Conditions apply.

Locked-in investment: Non-withdrawable Fixed Deposits require your investment to be fixed for a definite period. This locked-in approach guarantees that your funds are not only safe but also growing steadily.

Minimum amount is INR 3 Crores and maximum amount limit is as per the customer’s transaction limit.

Minimum tenure is 30 days.

No. Reinvest option is not available.

You can select monthly, quarterly, or cumulative interest payout to suit your financial strategy.

No. Premature withdrawal option is not available.

Interest rates will be applicable as per Fixed Deposit Plus rates.

Click here FD Rates

Deposit details are available on the dashboard in the Deposits section. Deposit Schedule and FD Advice can be downloaded.

- Log into Corporate Internet Banking

- Click on Deposits tab

- Select Deposit Type - Non-Withdrawable FD

- Enter OTP to authorize the transaction

Mutual Funds

Mutual Funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities and are managed by professional Fund Managers.

Mutual Funds offer diversification, professional management, liquidity and potentially higher returns as compared to traditional Savings Accounts or Fixed Deposits.

Corporate investors can choose from equity funds, debt funds, hybrid funds, money market funds and sector-specific funds, depending on their investment objectives and risk appetite.

A Sole Proprietor corporate customer can invest directly through the Corporate Internet Banking platform.

Minimum investment requirements vary by fund and AMC, so it is important to check specific fund documentation for details.

Most Mutual Funds allow redemptions at any time, but some may have specific terms or exit loads that apply.

Corporates can log in to CIB > Mutual Funds > Select Cust ID > click on Portfolio on PFM page to monitor their investments.

Yes, Mutual Funds can be included in corporate retirement plans, offering employees a range of investment options for their retirement savings.

Fees typically include expense ratios, management fees, and sometimes front-end or back-end loads. It is important to review the fund's prospectus for detailed fee information.

Kindly follow below steps

- Log in to Corporate Internet Banking

- On the dashboard, click on ‘Mutual Funds’

- Select Customer ID from the drop down menu

- Please click on ‘Continue’ to access Mutual Funds application

- You will be redirected to the Portfolio Management (PFM) page

- Select fund > Lumpsum or SIP option and click on ‘Continue’

- OTP will be received on the PFM registered email id and mobile number

- Enter OTP and click on ‘Verify OTP’

- You will receive a transaction confirmation message

Yes, you can invest in NFOs though Corporate Internet Banking.

SIP (Systematic Investment Plan) and Lump Sum (One-time investment) methods are available on Corporate Internet Banking to invest in Mutual Funds.

- Investment Management: View and invest in a wide range of Mutual Funds from various AMC’s directly through the platform

- Transaction History: Monitor past transactions and investment performance along with statement downloads

- Research and Analysis tools: Explore detailed performance reports and market insights

- User Experience: Seamless fund transfer to Mutual Funds, simple navigations, alerts and notifications

- Portfolio Management: View, manage and rebalance the entire Mutual Funds portfolio including gains, losses and asset allocation on the platform

- Explore Investment Ideas: Comprehensive resources and tools to help understand Mutual Funds investing better

Through Corporate Internet Banking, you can typically execute several types of Mutual Funds transactions, including Systematic Investment Plans (SIP), Lumpsum, Redemptions, Switching and Systematic Withdrawal Plans (SWP), viewing and tracking of Mutual Funds portfolio and performance and transaction history.

Apply

Now

Apply

Now

Apply

Now

Apply

Now